The White County Board of Commissioners held the second of three public hearings addressing the 2023 tax millage rate Thursday evening. During that public hearing, White County Finance Director Jodi Ligon shared information about the county operating budget and the proposed tax millage rate of 9.505.

Ligon pointed out the proposed millage rate will provide $12,720,948 in property tax revenue to help meet the county’s approved budget for the fiscal year. Ligon noted that the county is having to deal with several areas of increased expenditure,s including a $250,000 increase in ambulance service contracts and $363,000 in health insurance premium increases.

Following the presentation, the commissioners accepted public comments.

Four people spoke, all indicating their displeasure with an increase in their tax bill even though the commissioners are keeping the tax millage rate the same as last year.

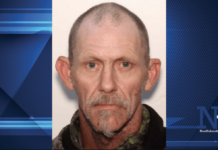

Todd Wooten of Cleveland was one of those. He told the commissioners, “There comes a point it’s time to say enough is enough. The citizens need a break.”

It was pointed out that the increase in property taxes is due to the increase in property value assessments, something the commissioners say they have no control over.

The commission and staff did offer some advice to taxpayers to make sure they are taking advantage of all exemptions. Ligon shared that the state will be assisting those who claim homestead exemption and $18,000 credit off the assessed value of their property. The county tax commissioner’s office will be figuring that into the final tax bills.

The commissioners will hold a third and final public hearing on the millage rate on Monday, July 31, before voting on it.