At a time when Habersham County voters are considering whether to assume more bond debt to build a new jail, White County officials are looking for a faster way to pay down their jail debt.

White County commissioners last night said they want to explore the possibility of using revenue from the county’s special local option sales tax (SPLOST) to help pay off jail bonds early.

During Monday’s commission meeting, White County’s SPLOST Manager Kevin Hamby told commissioners SPLOST revenue has been coming in well above the projected estimates.

Hamby said the county is expected to have around a million dollars to carry over into next year.

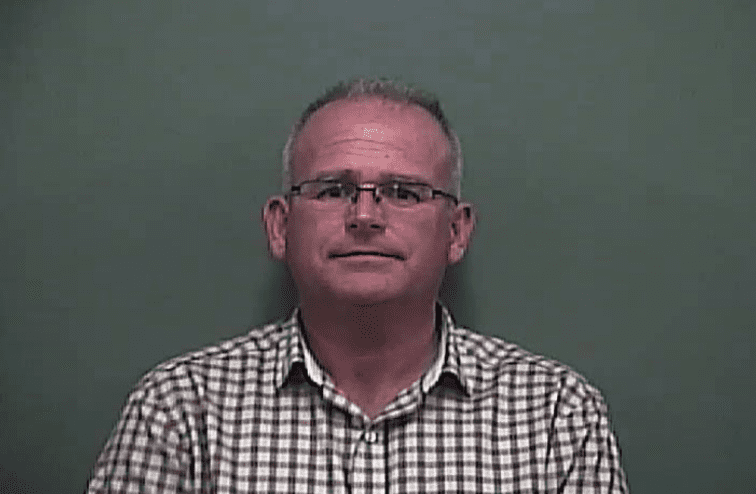

That prompted commission chairman Travis Turner to ask Hamby and the County’s Finance Director Jodi Ligon to come up with some figures for the commission to review.

“Run us some numbers with our accumulated debt service we set aside each month against the positives and negatives, the pros and cons about utilizing that cash to potentially pay off the jail a year early,” Turner said, adding, “because we are not earning anything on our money at the bank right now.”

The commissioners want to have the information to look at during their next work session.

Habersham County voters are deciding today (November 5) whether to approve a $31.7 million bond issue to pay for a new jail. If approved, the county will raise property taxes to cover the debt service on the bonds. That debt service would cost approximately $1,780,900 annually requiring a 1.38 millage rate increase, according to figures supplied by the county.

County Manager Phil Sutton says the tax hike would cost the average homeowner in Habersham – with an average home value of $135,000 – $71 more per year in property taxes.

(See amortization schedule & jail construction cost analysis).

WRWH News contributed to this report