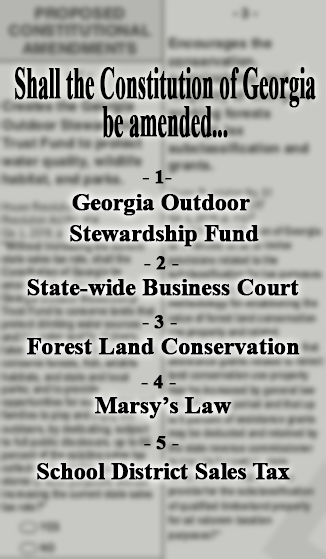

There are five proposed constitutional amendments and two statewide referendums on this year’s mid-term ballot in Georgia. Do you know what they mean?

Here’s a brief rundown to help you decipher and decide before you vote.

Amendment 1 – Georgia Outdoor Stewardship Fund

This would give the state the authority to dedicate “up to” 80% of the existing sales and use tax on outdoor sporting goods to land conservation. This was initially supposed to happen when the sales tax was put into place, but never occurred. The “up to” 80% language means the legislature is still not required to allocate the tax money but can allocate up to that percentage.

The funds would be used to support state parks and trails, provide stewardship of conservation lands, and acquire land for the provision or protection of clean water, wildlife, hunting, fishing, military installation buffering, or outdoor recreation. These initiatives would be carried out by creating the Georgia Outdoor Stewardship Trust Fund, which would be handled by the state. 40% of the 80% allocated would go to this fund.

It will appear on the ballot as follows:

Without increasing the current state sales tax rate, shall the Constitution of Georgia be amended so as to create the Georgia Outdoor Stewardship Trust Fund to conserve lands that protect drinking water sources and the water quality of rivers, lakes, and streams; to protect and conserve forests, fish, wildlife habitats, and state and local parks; and to provide opportunities for our children and families to play and enjoy the outdoors, by dedicating, subject to full public disclosure, up to 80 percent of the existing sales tax collected by sporting goods stores to such purposes without increasing the current state sales tax rate?

VOTING YES means you support allowing the state to authorize up to 80% of the sales tax on outdoor goods for conservation.

VOTING NO means you oppose allowing the state to authorize up to 80% of the sales tax on outdoor goods for conservation.

The Georgia Outdoor Stewardship Coalition is one of the main sponsors of this amendment as is The Georgia Conservancy.

Opponents of the amendment say it doesn’t go far enough or have enough enforcement teeth to require the money actually be used for conservation. It simply allows the state to send the money to the fund if it chooses.

Amendment 2 – State-wide Business Court

Amendment 2 would create a new court system in the state of Georgia, specifically for businesses. Judges in the business court would be APPOINTED not ELECTED. All judges would be appointed by the Governor to five-year terms subject to approval by the House and Senate judiciary committees. They could be reappointed for any number of consecutive terms as long as they meet the qualifications

It will appear on the ballot as follows:

Shall the Constitution of Georgia be amended so as to create a state-wide business court, authorize superior court business court divisions, and allow for the appointment process for state-wide business court judges in order to lower costs, improve the efficiency of all courts, and promote predictability of judicial outcomes in certain complex business disputes for the benefit of all citizens of this state?

VOTING YES means you support amending the Constitution to authorize the state to create a state business court and set the rules, term length and qualifications of the court.

VOTING NO means you oppose amending the Constitution to authorize the state to create a state business court which would appoint judges by way of the Governor, set the rules, term length and qualifications of the court.

This Amendment was sponsored by the Governor’s floor leaders and others, including Representatives Chuck Efstration, Terry Rogers, Trey Rhodes, Christian Coomer, Wendell Willard, and Barry Fleming. All are Republicans.

Governor Nathan Deal told WABE that, “A constitutional created business court would provide an efficient and dependable forum for litigants in every corner of our state.” This is a measure that was part of his Court Reform Council in his earlier years as governor. The amendment has the support of the Georgia Chamber of Commerce and is being pushed by Georgians for Lawsuit Reform.

Opponents argue the proposal surrenders too much authority to the state. Under existing law, Superior and State Courts already have the authority to establish “business court” divisions. These divisions, run by locally elected judges, operate similarly to drug and veterans courts.

Amendment 3 – Forest Land Conservation

This amendment would revise current law by subclassifying forest land conservation use property for ad valorem taxation purposes. It would also change the method for establishing the value of forest land conservation use property and related assistance grants.

This bill would allow the General Assembly to enact laws that would reduce the ad valorem tax on 200-acre or greater tracts of land that are placed under a covenant for conservation use. Any timber on the land would continue to be taxed without the benefit of the conservation covenant. The law further provides that the General Assembly may appropriate assistance grants to the local governments whose tax receipts will be reduced by having lower taxes on forest land placed under a conservation covenant.

Amendment 3 will appear on the ballot as follows:

Shall the Constitution of Georgia be amended so as to revise provisions related to the subclassification for tax purposes of and the prescribed methodology for establishing the value of forest land conservation use property and related assistance grants, to provide that assistance grants related to forest land conservation use property may be increased by general law for a five-year period and that up to 5 percent of assistance grants may be deducted and retained by the state revenue commissioner to provide for certain state administrative costs, and to provide for the subclassification of qualified timberland property for ad valorem taxation purposes?

VOTING YES means you support allowing the legislature to change the formula used to calculate the tax on forest land conservation use property and create a new land designation for commercial timberland. This also allows the state to establish a percentage of local grant assistance funding that could be retained by the state for administration.

VOTING NO means you oppose allowing the legislature to change the formula used to calculate the tax on forest land conservation use property and create a new land designation for commercial timberland.

The bill is supported by the Georgia Forestry Commission and Governor Deal. Andres Villegas, president and CEO of the Georgia Forestry Association was quoted saying, “For more than 100 years, the Georgia Forestry Association has been instrumental in timber tax legislation, which has positioned the state as a global leader in forestry. Thanks to the leadership of our elected officials and Governor Deal, we can, once again, ensure that our tax policy supports the growth and vitality of our working forests and the communities that depend on them.”

Amendment 4 – Marsy’s Law

Amendment 4, known as Marsy’s Law, addresses rights of victims of crime. It is part of a national effort to add additional rights and privileges for victims of crime.

The amendment allows, upon request, crime victims to have specific rights, including the right to be treated with “fairness, dignity, and respect;” the right to notice of all proceedings involving the alleged criminal; the right to be heard at any proceedings involving that release, plea, or sentencing of the accused; and the right to be informed of their rights. The amendment also explicitly stated that the legislature was able to further define, expand, and provide for the enforcement of the rights.

The amendment will appear on the ballot as follows:

Shall the Constitution of Georgia be amended so as to provide certain rights to victims against whom a crime has allegedly been perpetrated and allow victims to assert such rights?

VOTING YES means you support adding more rights of victims of crimes to the State Constitution, known as Marsy’s Law.

VOTING NO means you oppose adding more rights of victims of crimes to the State Constitution, known as Marsy’s Law.

Marsy’s Law for Georgia is a special advocacy organization created just for this bill and is the main sponsor. The amendment is endorsed by a number of victims’ rights groups.

Joe Mulholland, a District Attorney in South Georgia, told his local paper that the amendment is technically already part of the law. “It’s already technically part of Georgia law, but the legislature felt like being a part of the constitution is even stronger. Having that and knowing its part of the constitution, I think it gives peace of mind to prosecutors.”

The Georgia Public Policy Foundation, a nonpartisan think tank, has voiced concerns about the unintended consequences of the law, even penning a piece on it. You can read that here, but among the concerns are 1) additional attorney costs and costs for support staff for victims, 2) the risk of infringing the rights of someone accused of a crime, 3) an increase in false accusations, and seemingly most severe, the accused could “lose their right to be presumed innocent until convicted.”

The Georgia Public Policy Foundation also said in an article published on their website that “A constitutional amendment is no place to risk infringing the rights of someone accused of a crime. The accused have the presumption of innocence until convicted; their life and liberty are at stake. For many suffering victims and their surviving families, there’s a fine line between justice based on a court of law and vengeance based on the alleged wrongdoing.”

Amendment 5 – School District Sales Tax

Amendment 5 is the School Sales Tax Referendums Amendment. This amendment, if passed, would allow school districts or groups of school districts within a county to call for a sales and use tax referendum. For example: Fulton County and Atlanta City Schools or Cobb County and City of Marietta Schools.

The sales tax would be used for the educational purposes of the school districts and would be 1%. The term could be upwards of 5 years.

It will appear on the ballot as follows:

Shall the Constitution of Georgia be amended so as to authorize a referendum for a sales and use tax for education by a county school district or an independent school district or districts within the county having a majority of the students enrolled within the county and to provide that the proceeds are distributed on a per student basis among all the school systems unless an agreement is reached among such school systems for a different distribution?

VOTING YES means you support the amendment to allow a school district or districts with a majority of enrolled students within a county to call for a referendum to levy a sales tax for education purposes.

VOTING NO means you oppose the amendment to allow a school district or districts with a majority of enrolled students within a county to call for a referendum to levy a sales tax for education purposes.

Ballotpedia quotes Senator Ellis Black, a sponsor of the Amendment, in an interview saying, “the measure was designed to put provisions in place so that a school system with a majority of the full-time equivalent (FTE) students can place a renewal of an ESPLOST on the ballot before voters without having to ask all the systems within a county. Black also said the measure was designed to prevent a smaller school system from essentially blackmailing a larger school system within the county from passing a resolution to place an ESPLOST renewal on the ballot, and similarly, that it would stop a larger school system from preventing smaller systems from putting the issue before voters.”

The bill passed 33-17 down party lines.

Referendums

The two ballot referendums, also known as “legislatively referred state statutes, appear because the state legislature voted to place those measures on the ballot for voters to decide. [ Georgia does not allow citizen-initiated ballot referendums.] The proposed changes referred by the legislature are changes in the laws – by way of approval or rejection – but do not alter the state Constitution.

Referendum A – Provides for a Homestead Exemption for residents of certain municipal corporations

The referendum stems from House Bill 820 in the Georgia legislature. It was approved 158-6 in the House and 55-0 in the Senate. State Representatives John Pezold, Michael Caldwell, Park Cannon, Matt Gurtler, David Stover, and Scot Turner voted NO. Five of the six of the NO votes are limited government conservative state representatives.

The question on the ballot will read:

“Do you approve a new homestead exemption for a municipal corporation that is located in more than one county, that levies a sales tax for the purposes of a metropolitan area system of public transportation, and that has within its boundaries an independent school system, from ad valorem taxes for municipal purposes in the amount of the difference between the current year assessed value of a home and the adjusted base year value, provided that the lowest base year value will be adjusted yearly by 2.6%?

This one is confusing, so bear with me.

For most people, this referendum will not apply because they do not meet all the criteria. The measure was sponsored in the House & Senate by metro Atlanta legislators, but once it becomes law, it could affect any city or county that someday meets the criteria.

The “adjusted base year value” is defined as either the lowest base year value or, if available, the previous base year value adjusted annually by 2.6 percent plus any change in value. “Lowest base year value” for exemptions first granted in the 2019 tax year is defined as the lowest among the 2016, 2017, and 2018 valuations multiplied by 1.0423, which is the inflation rate for December 2015 through December 2017.

These municipalities referenced already have different millage rate and taxation guidelines.

VOTING YES — means you support the measure to provide a homestead property tax exemption for some cities equal to the difference between the current year and the adjusted base year.

VOTING NO — means you do NOT support the measure to provide a homestead property tax exemption for some cities equal to the difference between the current year and the adjusted base year.

If approved, it will change and make law OCGA 48-5-44.1. Approval by the voters means it will take effect on January 1, 2019 and will apply to all tax years beginning on or after that date.

Referendum B – Provides a tax exemption for the mentally disabled.

The referendum stems from House Bill 196 in the Georgia legislature. This bill started off as a music industry tax credit piece of legislation but was gutted from its original form to include the language for the nonprofits in order to get the bill passed before the close of the legislative session. Therefore, if you search the legislation, it may appear with a different name and subject matter but the content reflects what the referendum pertains to.

This initiative was sponsored by State Representative Matt Dollar and passed 49-5 in the Senate and 149-3 in the House. The three dissenters in the House were State Reps Matt Gurtler (R), Brenda Lopez (D), and Matt Dollar (likely because his bill was gutted from its original intent and replaced with an initiative of someone else.) The give dissenters in the Senate were Senators Bill Heath (R) , Lester Jackson (D), Emanuel Jones (D), David Lucas (D), and Josh McKoon (R ).

The question on the ballot will read:

“Shall the Act be approved which provides an exemption from ad valorem taxes on nonprofit homes for the mentally disabled if they include business corporations in the ownership structure for financing purposes?”

B is much easier to understand than A and is a simple exemption for nonprofit organizations that assist the mentally disabled, even in instances where corporations are involved. Essentially, homes that are owned by Limited Liability Corporations, LLCs, are exempt from taxation if the parent company is a 501(c)3 nonprofit.

Concerns would be that corporations would use the nonprofit industry as a tax shelter. Additionally, any ‘exemption’ or manipulation of the tax code provides for a different standard of treatment for a specific group of people – making some more equal under the law than others.

VOTING YES means you support this measure to allow a tax exemption for nonprofits that serve the mentally disabled even in instances when housing constructed is paid for by financing from corporations.

VOTING NO means you DO NOT support this measure to allow a tax exemption for nonprofits that serve the mentally disabled even in instances when housing constructed is paid for by financing from corporations.

If approved, it would amend OCGA 48-5-41 and would become law beginning January 1, 2019.

You can visit ‘My Voter Page’ on the Georgia Secretary of State’s website to get a full size sample ballot. Early voting is already underway and Election Day is Tuesday, November 6, 2018.

This article originally appeared on AllOnGeorgia.com

About the author: Jessica Szilagyi is a Statewide Contributor for AllOnGeorgia.com. She focuses primarily on state and local politics as well as agricultural news. She has a background in Political Science, with a focus in local government, and has a Master of Public Administration from the University of Georgia. She’s a “Like It Or Not” contributor for Fox5 in Atlanta and has two blogs of her own: The Perspicacious Conservative and “Hair Blowers to Lawn Mowers.”