While Habersham County Commissioners say they do not intend to raise the millage rate, property owners will still see another tax increase this year. That’s because of higher property valuations.

Commissioners Jimmy Tench and Bruce Harkness, who both voted against last year’s millage rate increase, have said they are open to a tax rollback this year to give taxpayers a break. The three commissioners who voted last year to raise the millage rate have given no indication they would support that. Commissioner Bruce Palmer, in fact, has said he will not.

“I think we need to leave it [the millage rate] the same as it is. Habersham County has so many issues we just can’t keep rolling the millage rate back. I understand everybody is having problems with inflation, but the county is no exception to that. Everything has gone up for the county, too,” he told Now Habersham after a public hearing on the proposed tax increase.

Exemptions increased

During that meeting, Habersham County Finance Administrator Kiani Holden presented an overview of the millage rate process, explaining the respective roles of the tax commissioner, Tax Assessors Office, and county commission in determining the tax digest, millage rate, and tax collections.

Holden explained that since the commission indicated during the budget process that they were not raising or lowering the millage rate, it would stay the same as last year’s rate at 12.682 mills. By not rolling back the reassessment increase, the county will receive an additional $1,761,954.

In Holden’s presentation, she also explained that exemptions increased by $136,582,505 this year over last year. The exemption increase would’ve generated approximately $1.7 million in tax revenue that could have allowed the county to do the rollback this year.

Commissioner Bruce Harkness asked Holden, “Do you all have a breakdown?” Holden replied that she didn’t have it with her, but she could get it. She explained to Harkness, “Out of the 13,000 properties that are residential properties, over half of those have a homestead exemption, and the majority of those are the property (assessment) freeze.”

County Manager Alicia Vaughn confirmed, “The majority of it would be the homestead exemption freeze.”

RELATED Property owners speak out against proposed property tax increase

State and county school board tax breaks

Vaughn added that the state is giving a one-time relief to taxpayers this year in the amount of $18,000 for those who have the homestead exemption. That amount will be applied to the assessment value, reducing the taxpayer’s property tax. She explained that it was not on the property assessment notices, but it will be reflected on property tax bills.

Vaughn told the audience that when property assessments were sent out that they used last year’s millage rates to give property owners an estimate of what their tax bills may look like with the new assessments. She added that those assessments did not include the $18,000 tax relief grant from the state or the Habersham County Board of Education’s rollback that was approved last week.

“Most people, in general, are going to see a much lower tax bill than what they see on the assessment,” she said.

“If you qualify for homestead exemption in Habersham County, you’ll see the additional $18,000 homestead exemption on your tax bill, and so that will reduce your overall tax bill,” said Vaughn. “If you live in the unincorporated area of Habersham, it’s around a $450 reduction in your tax bill, as an example.”

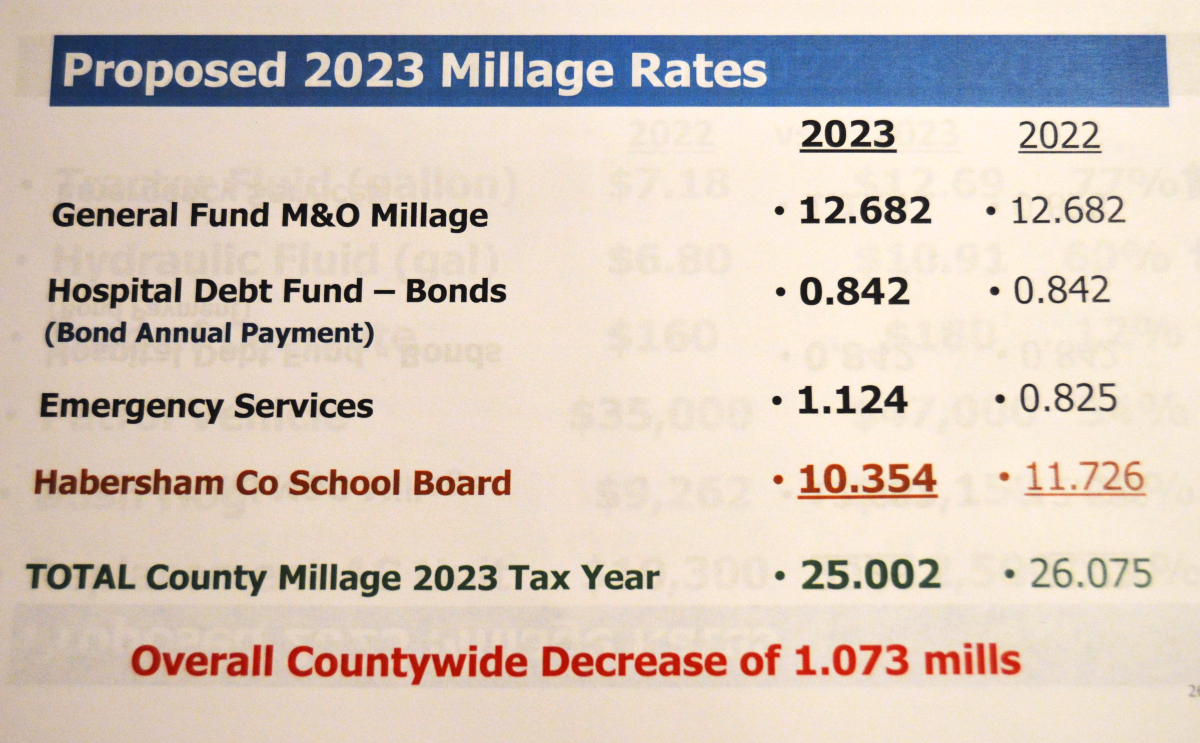

According to Holden, since the school board rolled back its millage rate, the total millage rate will decrease for the county overall. Below are the anticipated millage rates across the county. The Habersham County Board of Education approved their rollback millage rate last week.

After the presentation and discussion, Commission Chairman Ty Akins opened the floor for the public hearing. Several property owners spoke in opposition to the proposed tax increase.

SEE ALSO

Habersham County property owners speak out against proposed tax increase