It was a small, but intense crowd that showed up Monday evening for the fourth in a series of town hall meetings on Habersham County’s transportation special purpose local option sales tax. Opponents called into question several aspects of the initiative, including cost and timing, while supporters insisted the county has “kicked the can” on roads “down the road” for too long.

Habersham County Commission Chair Bruce Palmer hosted the event. It was his third T-SPLOST town hall meeting since July and fourth, overall, for the county. (Palmer has also hosted at least four Facebook Live Q&A sessions.)

Sharing his familiarity of the topic with the crowd of about 15 at the Ruby Fulbright Aquatic Center in Clarkesville on Monday, Palmer stated there are 42 counties in Georgia that have a single county T-SPLOST. Sixty-two others have some sort of T-SPLOST, whether single or regional. Fifty-five counties in Georgia do not have a T-SPLOST.

WATCH T-SPLOST Oct. 3, 2022 Town Hall

Currently, Habersham County relies on grants from the Georgia Department of Transportation to meet its road maintenance needs. The Local Maintenance Improvement Grants (LMIG) pay 70% of the cost, while the county pitches in the rest. However, LMIG has a cap. Palmer explained LMIG funding is based on how much fuel sales tax is collected in Habersham County. The maximum grant amount the county could receive this year was $746,107, causing the county to pay more than its 30% match.

In addition to LMIG, Habersham relies on SPLOST funding to pay for road projects. SPLOST 7, which voters approved last November, is expected to generate approximately $1.6 million a year over the next six years – $9.7 million total – for road construction, maintenance, bridge updates, and repairs and replacements.

In addition to LMIG, Habersham relies on SPLOST funding to pay for road projects. SPLOST 7, which voters approved last November, is expected to generate approximately $1.6 million a year over the next six years – $9.7 million total – for road construction, maintenance, bridge updates, and repairs and replacements.

With rising costs, Palmer said he fears what could happen in 2023.

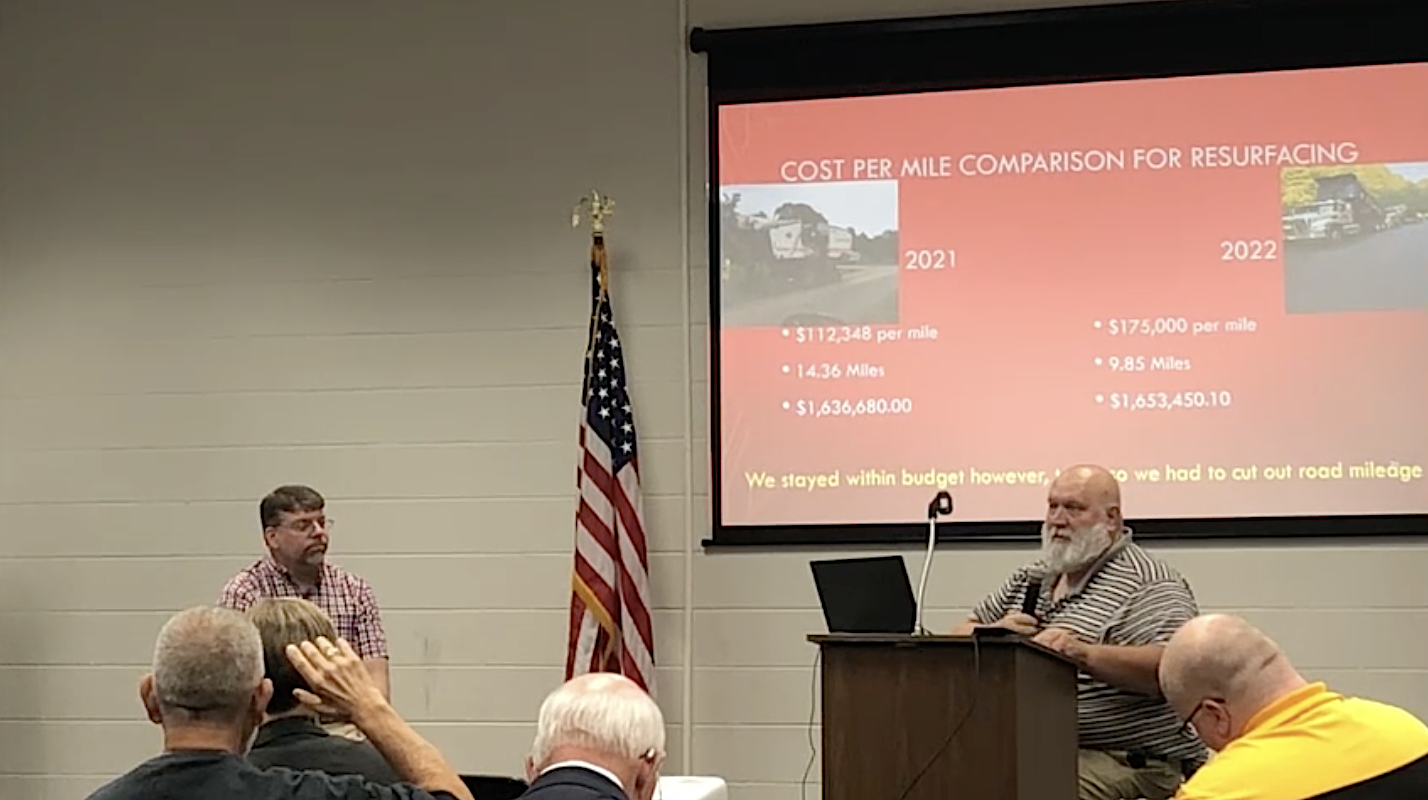

Georgia has suspended its state fuel sales tax and that, Palmer warned, could have an effect on the LMIG grant the county receives. Habersham County has 410.89 miles of paved roads, 96.76 miles of gravel roads, and 61 bridges. In 2021, the county paid on average $112,348 per mile for paving. In 2022, it is now averaging $175,000 per mile.

As for Habersham’s bridges, Palmer said a bridge inspection report from GDOT showed 15% of the county’s bridges are deficient, 18% are in need of repairs and rehabilitation, and six bridges are obsolete. He also stated that bridges 20-feet or less were not on GDOT’s list. He noted that several bridges in the county flood during heavy rain events. And he demonstrated that culvert pipes had increased in price over the last few years with plastic pipe almost doubling in price and metal pipes, tripling.

When Palmer brought up other counties and their recent or upcoming T-SPLOST referendums, that several audience members took him to task.

“I am confused why you have brought up a couple of times what these other counties are doing with the SPLOST when you’re not allowed to promote a SPLOST?” questioned local business owner Bob Guthrie. “I don’t see any relevancy as to what any other counties in Georgia are doing with their SPLOST.”

“I used those other counties as a comparison to show that we’re not the only county doing this. We can’t promote it and I am not telling anybody to vote for it or vote against it,” Chairman Palmer replied. Guthrie responded, “I would like to see, just zero in on what this SPLOST is for and not compare it, because that is a promotional type.”

“It is a fact that Rabun County has a Roads and Bridges SPLOST. It is a fact that Banks County has a Roads and Bridges SPLOST,” Palmer continued. “It is a fact that all of these other counties have a Roads and Bridges SPLOST.” At which point Virginia Webb responded, “Many counties have voted it down…..you’re not listing Monroe County, Union County, Oconee County, you’re not listing Newton County, that have all voted it down.”

Webb, a local Democratic Party leader who last week released a jointly-signed letter with the chairman of Habersham County’s Republican Party rejecting T-SPLOST, questioned Palmer on how the proposed tax measure is being promoted. She held up a yard sign, one of many that have been popping up along city and county roadsides lately, promoting the ‘Roads and Bridges SPLOST’ which is the same as T-SPLOST.

Because state law forbids government officials from actively promoting special purpose

local option sales tax referendums, political action committees are often formed to handle the marketing. In this case, as in the previous T-SPLOST, the Partnership Habersham group is putting out the signs, Palmer said.

Virginia Webb and Richard Webb, no known relation, both expressed strong opposing viewpoints.

Calculating the expected overall impact of the proposed T-SPLOST, Virginia Webb said she calculated it will cost each resident approximately $143 per year, or $717 over the 5-year life of the tax.

“When you take ESPLOST and SPLOST and when you add those three [taxes] together, that is over $2,400 that each person is going to be paying for these three SPLOSTs over the next 5 and 6 years. That’s a lot of money you are asking for,” she said.

“I find at this time is not the right time to be raising more taxes when we just had the largest millage rate this century,” Virginia Webb said. “This is beginning to be a burden on the citizens that I don’t believe is justified for our county at this time.”

Richard Webb disagreed.

“We need to catch up on our roads and bridges so we can keep up on our roads and bridges,” he said.

“When we look at cost, we’re talking about a penny per dollar. If you spent a thousand dollars, that’s going to be $10. That’s less than two Starbuck’s cups of coffee…In this county, we can’t kick the can down the road. I understand that prices are going up,” he said, “the prices are going up for the county as well. They can’t keep doing what needs to be done with the budget they got to do it with.”

Local developer Wade Rhodes called the county’s need for a new jail and hospital bond debt as “serious issues” the county is facing.

“The only way to put some money in the coffers to take care of these things is to move roads and bridges to a sales tax revenue that everybody pays, not just property owners,” Rhodes said. “A sales tax is the fairest tax there is. It’s not just on the property owner’s shoulders. Good, bad, or indifferent, taxes should have been raised 10 years ago.”

Without T-SPLOST, Palmer says the only alternative is to make budget cuts to pay for the necessary services. He pointed out that Public Safety and Public Works are the county’s two largest budget items. “Do we cut the Sheriff’s Department, the Fire Department?” Palmer asked rhetorically.

Virginia Webb asked, “When are you going to build a new jail? That needs to be a priority.”

Palmer responded, “How do you propose we build a jail? What funding mechanism?”

“What about another bond referendum?” she replied, to which he then responded, “We had it on the ballot a couple of years ago and it was voted down.”

“This one [T-SPLOST] was voted down also,” she said.

Habersham County Attorney Doug McDonald, a staunch critic of the county’s recent tax increases and spending, questioned how much time and money the county has spent on its T-SPLOST meetings. A seemingly agitated Palmer deferred to the audience asking them to, “Raise your hand if you got anything at all out of the meeting tonight?” As several audience members and county employees raised their hands, McDonald responded, “Sure, vote no.”