The economic fallout of the COVID-19 pandemic is now becoming evident on the state’s balance sheet.

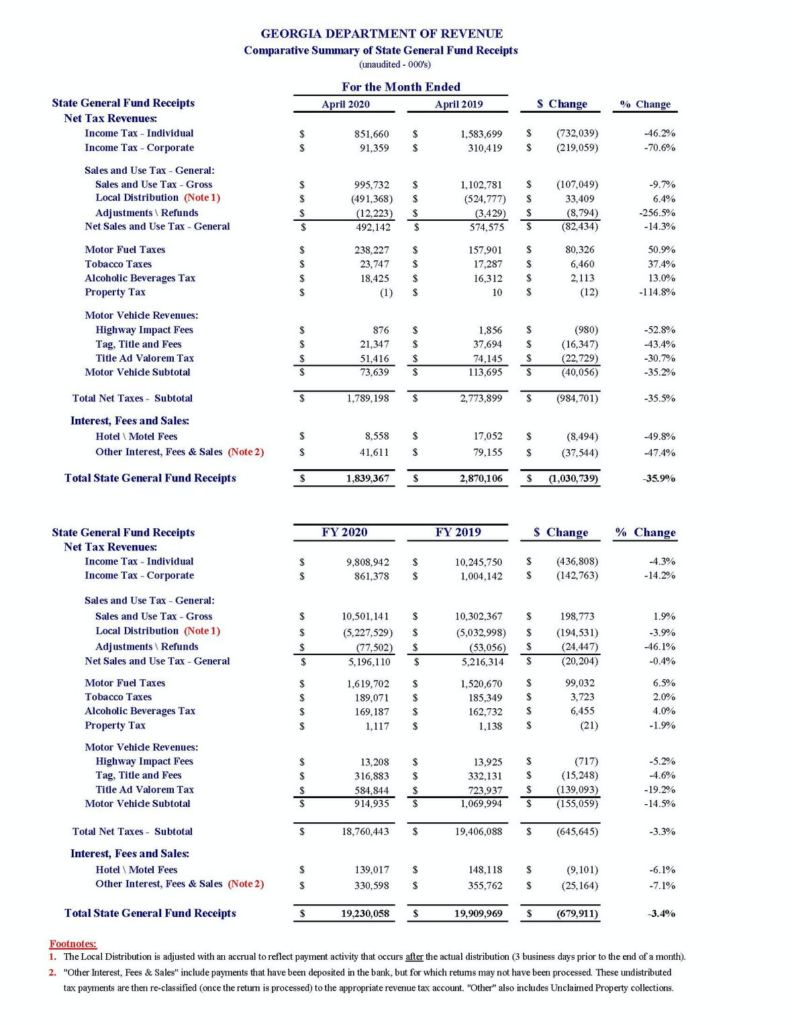

Georgia’s net tax collections for April were down $1.03 billion over last year’s. The state took in $1.84 billion last month, compared to $2.87 billion. in April 2019. That’s a decrease of 35.9%.

Year-to-date net tax collections totaled $19.23 billion for a decrease of nearly $680 million, or -3.4 percent, compared to the previous fiscal year (FY) when net tax revenues totaled $19.91 billion.

The governor’s office says the decrease in revenues is largely attributable to the economic impact of the COVID-19 pandemic. In particular, the shifting of payment deadlines related to motor vehicle, corporate tax, and individual income tax.

Individual Income Tax collections for April declined by $732 million, or -46.2 percent, down from April 2019 when net Individual Tax revenues totaled roughly $1.58 billion.

Georgia pushed back its filing date this year due to the pandemic. Georgians have until July 15 to file their state and federal tax returns.

RELATED

With state budget under strain, call to raise tobacco tax is renewed