Editor’s Note: The following legislative update is from Rep. Victor Anderson (R-Cornelia) who represents the 10th State House District of Georgia. The District includes portions of Habersham and White counties. Anderson presently serves on the House Energy, Utilities & Telecommunications Committee, Governmental Affairs Committee, and State Planning & Community Affairs Committee. He also chairs the study committee on annexation and cityhood issues.

Greetings from under the Gold Dome!

Tuesday, January 18, marked the beginning of what we refer to as, “budget week.” The only thing that we are constitutionally required to do during our 40-day session is pass a balanced budget. While balancing a budget seems simple enough, when dealing with billions of dollars, it can be quite challenging. As many states continue to find themselves under stressful budget cuts, our fiscal conservatism, and the fact that our state remained open for business through the pandemic, have made it possible for us to stay on par with pre-pandemic budget allocations.

Over the last week, House and Senate Appropriations Committees held a series of joint budget hearings, which gave us the chance to closely examine Governor Kemp’s recommendations. As our state’s fiscal year begins July 1, we are in the first stages of crafting two budget bills: The full 2023 Fiscal Year budget and the 2022 Amended Fiscal Year budget. Please see below an outline of budget happenings.

As always, I will be updating you weekly on all happenings concerning your government at work. If you have concerns or questions regarding legislation, I ask that you reach out to our office directly. Thank you for allowing me the honor and privilege of serving our home under the Gold Dome. May God bless you, and may He continue to bless the great state of Georgia.

2022 Fiscal Year- Spending Changes

The 2022 budget will be amended to reflect a more accurate estimate of state revenue and accounts for discrepancies between the projected estimate that was passed last year, and actual revenue obtained.

Governor Kemp began the week by presenting his recommendations to the House and Senate Appropriations Committees. Highlighted below are a few spending changes, which include a taxpayer refund, proposed by Governor Kemp for the 2022 amended budget, which will end June 30 of this year:

- $1.6 million in undesignated regular surplus to be used to provide refunds for all taxpayers for the 2021 tax year between $250 and $500.

- $382 million to restore the Quality Basic Education (QBE) program and $5.5 million to restore other programs directly supporting K-12 instruction.

- $56 million for transportation projects per HB 170 (2015 Session).

- $4 million for the Integrated Eligibility System costs for the implementation of the Patients First Act (2019 Session).

2023 Full Fiscal Year Budget

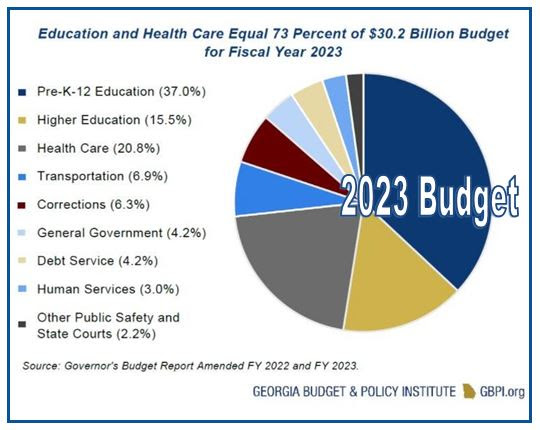

In his State of the State Address last week, Governor Kemp announced that the 2023 fiscal year budget proposal is set for an estimated $30 billion. The governor listed his funding recommendations, and as expected, education and healthcare remain at the forefront of budget funding, receiving approximately 73% of the state’s overall budget. Public safety, transportation and general government round out the top spends collectively taking most of the remaining budget allocations.

Below is a highlight of Governor Kemp’s 2023 FY budget proposals:

Education

- $2,000 pay raise to our K-12 teachers, assistant teachers, and pre-k teachers.

- $1.4 billion in direct funding for our K-12 schools

- Restores $388 million in both fiscal years to eliminate the austerity cuts that were made at the start of the pandemic.

- $79 million to fund program growth to allow the HOPE programs to cover at least 90 percent of tuition at the state’s public institutions.

- Restores more than $271 million in austerity cuts that were previously made to our higher education systems.

- $35 million for the State Commission Charter Schools supplement to recognize a 23.79 percent increase in enrollment at state charter schools.

Healthcare

- $139 million to implement the state’s reinsurance program and online health insurance portal to keep insurance plans and premiums more affordable.

- Adds $85 million for improved provider rates to stabilize the state’s Medicaid system

- $33.5 million to fund the state’s mental health crisis networks and services that benefit individuals with behavioral and developmental disabilities.

- $27.8 million to provide a 10 percent provider rate increase, which would offset the rising costs of caring for our state’s foster children.

Public Safety

- $1.6 million to establish a gang prosecution unit in the attorney general’s office and expand the state’s human trafficking unit.

- Several million dollars for the Georgia Bureau of Investigation’s medical examiners and forensic services, which have experienced backlogs in processing criminal evidence.

- $600 million to purchase a newer prison facility and build a 3,000 bed facility to house medium and high-security prisoners.

Rural Initiatives

- $1.8 million for the Georgia Agricultural Trust Fund generated through agricultural tax exemption fees to provide funding for the maintenance and operations of state farmers’ markets and marketing and promotion of Georgia agricultural products.

- $2.5 million for 136 residency slots and $1 million to Mercer University to address rural physician shortages.

Transportation

- $48 million for the Department of Transportation to reflect FY 2021 motor fuel revenue collections.

- $20 million for the Transportation Trust Fund for transportation projects, result of HB 511 (2021 Session).

- $8 million for the Georgia Transit Trust Fund for transit projects, result of HB 511 (2021 Session).

What’s Next?

Although budget week has technically come to an end, our work is far from over. House Appropriation subcommittees will further study budget proposals, eventually passing portions of the suggested budget out of their respective committees. Following this process, those individually passed budgets will then go before the full House Appropriations Committee. Soon after, the budget will receive a full vote on the House floor.

When passed by the House, it then moves over to the Senate, where the process begins all over again. During Senate budget hearings, we will either approve or change House recommendations. If both Chambers agree on the budget, it goes to the Governor’s desk for his approval and signature. We will keep you updated on anything specific to our region.

Budget links

Here are some budget links you may find helpful in researching and understanding the state’s budget process:

- Zero Based Budgeting (https://gmail.us1.list-manage

.com/track/click?u=592df309c67 37eed8c1e2e754&id=c71997f2a0& e=d6cc1b67a0) - Governor’s Budget Report AFY 2022 / FY 2023 (https://gmail.us1.list-manage

.com/track/click?u=592df309c67 37eed8c1e2e754&id=532b7bdc33& e=d6cc1b67a0(4).pdf) - Budget Process (https://gmail.us1.list-manage

.com/track/click?u=592df309c67 37eed8c1e2e754&id=ed64cf66fd& e=d6cc1b67a0) - Budget Hearing Video Archives (https://gmail.us1.list-manage

.com/track/click?u=592df309c67 37eed8c1e2e754&id=388f65aba5& e=d6cc1b67a0) - Georgia Budget and Policy Institute (https://gmail.us1.list-manage

.com/track/click?u=592df309c67 37eed8c1e2e754&id=e4685f3f77& e=d6cc1b67a0)