Investing more in Georgia’s schools, health care and state employees were dominant themes during annual budget hearings conducted at the state Capitol this week, as lawmakers begin working on Gov. Brian Kemp’s $32.5 billion spending proposal for the next fiscal year.

Many leaders of Georgia’s executive and judicial branch offices shed light on their desired tweaks to funding for the $30.2 billion current fiscal year budget that ends June 30 as well as next year’s record-setting plan that begins July 1.

READ Gov. Kemp’s proposed budget

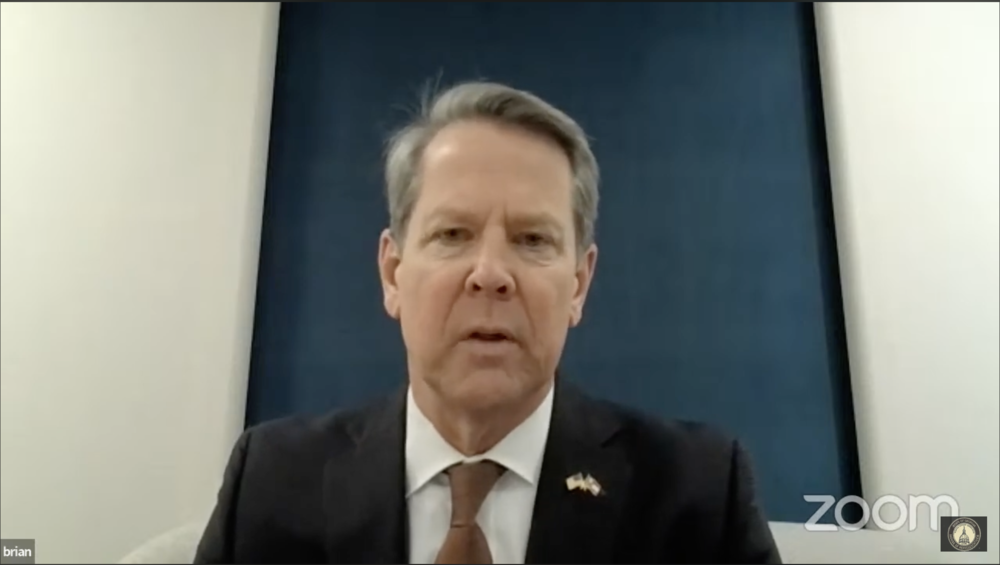

Georgia ended the last fiscal year with more than $6 billion in surplus money after filling its “rainy day fund’ savings account to the maximum of just over $5 billion, and the governor is asking lawmakers to return about half of that back to Georgia taxpayers through an income tax refund and one-time property tax rebate for homeowners. Kemp, addressing the committee from the World Economic Forum in Davos, Switzerland, on Tuesday, said his first budget of his second term reflected promises he made to Georgians.

“The first is the second income tax refund, returning over $1 billion in surplus bunds where they belong — back in the taxpayers’ wallets, just like I did last year with your help,” he said. “Eligible Georgians will receive $250 as a single filer and up to $500 as joint filers.”

The property tax relief would take the form of a $20,000 exemption for the assessed value of a homestead, with an estimated average savings of $500.

Georgia’s fiscal economist, Jeffrey Dorfman, gave a wide-ranging presentation that explained the state’s overall economic picture, noting strong job growth that has led to record low unemployment.

“Importantly, the sectors that have grown the most pay more,” he said. “So this has boosted personal income in Georgia and has been responsible for a lot of the growth in tax revenue that we all have enjoyed the last couple of years.”

But Dorfman said the recent trend of overflowing state coffers could be less in future years, as another segment of growth — capital gains taxes derived from growing investments in the stock market — will likely not repeat itself.

“We ran a $6.6 billion surplus last year — over half of that was due to those capital gains taxes that we will not see again, and over a third of it came in in about two weeks in April,” he said.

Dorfman said that also explains why the amended budget for this fiscal year has a revenue estimate much lower than the roughly $37 billion that was collected during last fiscal year, and is closer to pre-pandemic baselines of spending and collection.

The other largest piece of the proposed budget would see state employees, teachers and other certified school employees receive another $2,000 pay raise, as multiple agency heads told lawmakers that lower salaries were preventing them from recruiting and hiring people to work important jobs, from prosecutors in the attorney general’s office to inspectors for the Department of Agriculture.

“We interview those folks, they go through the interview process, and they end up deciding to take other opportunities because most of those other opportunities pay more,” new Agriculture Commissioner Tyler Harper said.

The General Assembly approved $5,000 pay raises for state employees last year and raised teacher pay by $5,000 over the last several years as Georgia’s collections grew after the coronavirus pandemic saw lawmakers proactively cut roughly 10% from many agencies in a $25.9 billion spending plan that started July 2020.

But the economic outlook of Georgia has remained strong, and Kemp’s budget includes language that would expand the HOPE scholarship program to cover 100% tuition at University System of Georgia schools, while chancellor Sonny Perdue warned lawmakers about a growing number of students choosing to go outside of Georgia for college. There is also money to fully fund the state’s K-12 education formula, hire more school counselors and help paraprofessionals become certified teachers.

Kemp’s plan also would increase spending on programs that expand access to health insurance and keep costs low, though Republican leaders in the state are not exploring a full expansion of Medicaid.

Looking ahead to 2024, Secretary of State Brad Raffensperger asked lawmakers for money to implement a tracking service for mail-in absentee ballots integrated with the United States Postal Service, a data plan for check-in tablets used at polling places on Election Day and replace the universal power supply (UPS) battery backups used to power voting machines.

“The current UPS is a lead-based battery, it’s robust, it also weighs 80 pounds,” Raffensperger said. “Our average poll worker has an age of over 65 years old, it’s a burden.”

Other notable budget items include the creation of a new statewide public safety radio network, $105 million for a new electronic records system at the Medical College of Georgia and funds to build two facilities through the state’s Quick Start program that will provide customized training for new Rivian and Hyundai electric vehicle plants coming to the state, two of the largest economic development announcements in Georgia’s history.

________

This article appears on Now Habersham through a news partnership with GPB News