Habersham County’s largest industry and retailer are among the property owners benefiting from tax appeal scheduling snafus. Fieldale Farms and Walmart are both due partial refunds after the county failed to schedule a Hearing Officer within the required timeframe to handle the companies’ reassessment appeals.

Fieldale Farms is expected to receive refunds on three parcels, including its poultry processing plant, BC Grant warehouse, and feed mill.

By law, appeals must be heard within 180 days of being filed. In these cases, tax officials say, they were not.

Now Habersham has learned Scenic View Healthcare in Baldwin is another of the properties the Habersham County Board of Tax Assessors was referring to in a letter sent to Habersham County Clerk of Court David Wall. In that letter dated November 30, the board asked Wall to review his office’s procedures for scheduling hearings after missed deadlines cost the county nearly $334,000 in tax refunds.

While the letter made it appear as though the clerk of court’s office was at fault, during a press briefing on Monday, it was revealed that the tax assessors’ office sent the appeals to Wall’s office after the 180-day window had expired. Other appeals requesting a Hearing Officer were mixed in with appeals to the Board of Equalization. The board heard those appeals, but the appellants were not assigned a Hearing Officer as requested.

COVID, change, and confusion

Habersham County Manager Alicia Vaughn explained in the briefing that in 2019 state law governing the appeals process was changed. This change caused confusion about how appeals were to be handled. She also said that the Georgia Department of Revenue did not offer training related to the legal change at that time.

In 2020, COVID became a factor when court and hearing dates were not being set, and the availability of Hearing Officers was limited.

According to Vaughn, the required refunds will cost Habersham County’s government $173,590 and the Habersham County Board of Education $160,238.

Vaughn distributed a letter to the media seeking to distance county leadership from the loss, stating, “the Board of Commissioners has no authority and does not provide oversight for the appeal process.”

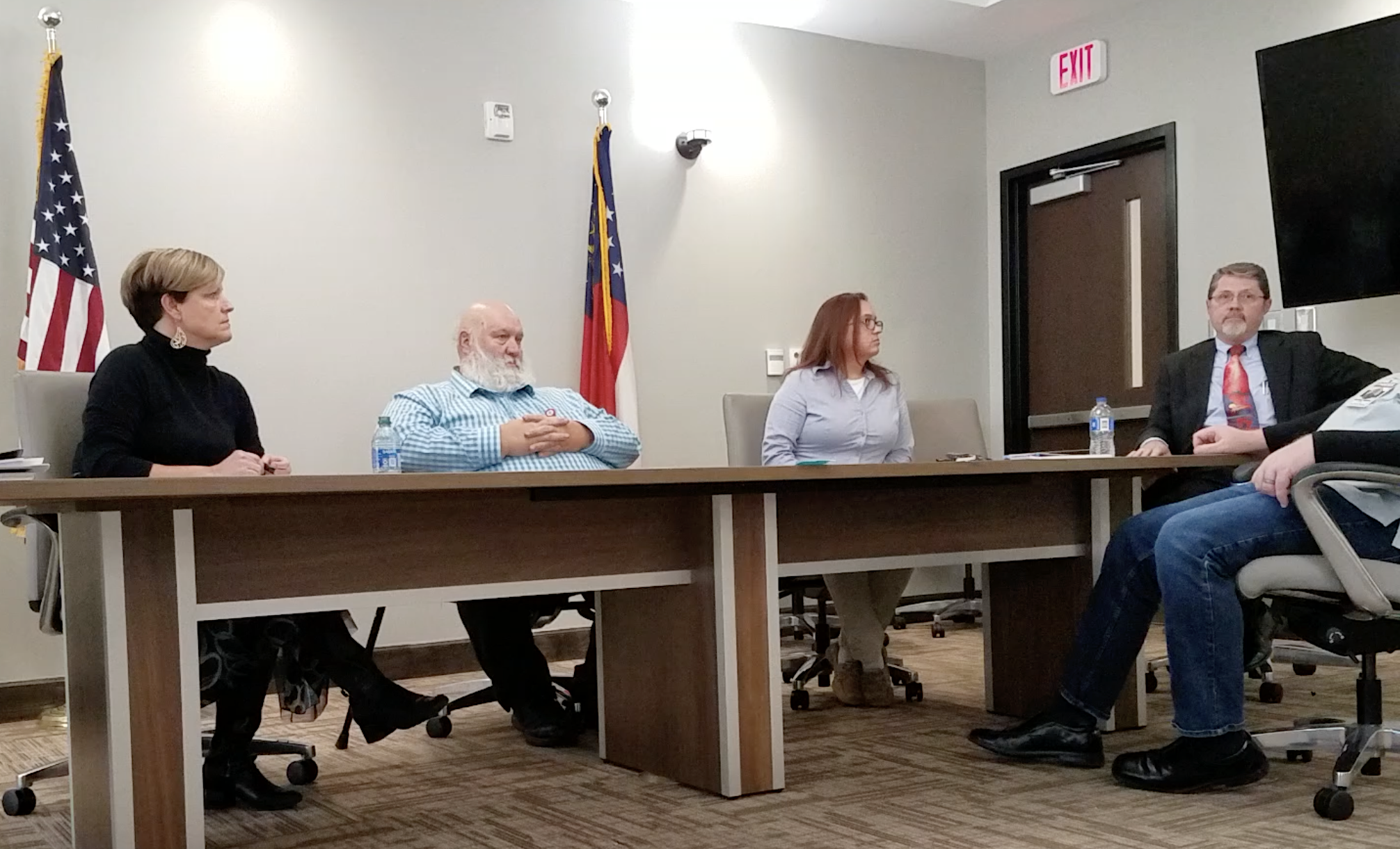

Wall and Habersham County Board of Tax Assessors Chair Mariah Holbrooks attended the December 12 briefing at the county administration building in Clarkesville. They agreed to address their policies and procedures to avoid confusion and become more efficient in the future. Holbrooks said the board of assessors will develop a checklist to ensure procedures are followed and will track hearing requests so that it’s clear to the clerk of court’s office who needs a hearing and when.

Vaughn said she reached out to the revenue department about possible training related to the 2019 law. She said the agency is “looking into it.” She also stated that money is available in the budget for training.

The tax refunds to Fieldale, Walmart, Scenic View, and others will be issued by the Tax Commissioner’s office, according to Habersham County Finance Director Tim Sims. Tax commissioner June Black is expected to process those refunds once her office receives affidavits from the Board of Tax Assessors outlining who to refund and how much.

This issue will have a ripple effect across the county and will affect all tax districts, said Sims. Since some of the properties are within the city limits and the cities used the same assessments as the County and the School Board, the cities will be required to issue refunds as well.

Baldwin and Cornelia have both received affidavits from Haberseham’s Chief Appraiser and Board of Assessors Secretary, Amy Garmon, related to those properties within their respective city limits.

Baldwin will have to refund $11,606.81 to Scenic View, while Cornelia is due to refund Fieldale $31,897.15 and Walmart $7,365.28.

The total refund liability to Cornelia is $39,262.43.