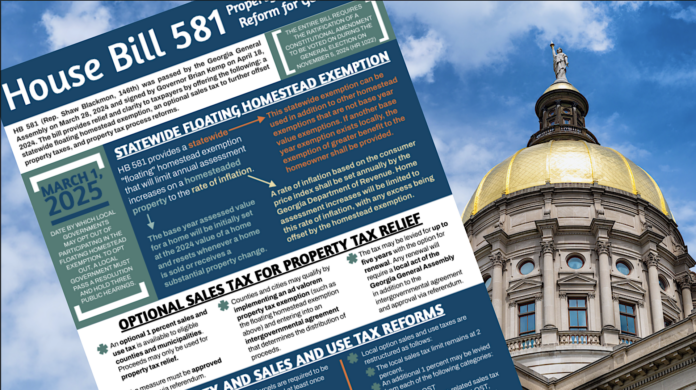

Local government officials across Georgia are grappling with whether to remain in the new constitutional amendment passed by voters in November or opt out of its provisions. The deadline to make a decision is fast approaching, with a final cutoff of March 1.

However, for those local governments opting out, the decision must be made much sooner, as the law requires them to hold three public hearings, pass a resolution, and submit it to the Secretary of State’s office by the deadline.

Why opt out?

Several local governments and school boards across the state are considering opting out of HB 581. By opting out, local governments would not be bound by the provisions set forth in the law for property tax relief.

They would not be bound to capping homestead exempt property valuations to the inflationary rate determined by the Georgia Department of Revenue (DOR) as the new law requires. Those properties would remain valued each year at the market inflationary rate.

Local governments that opt out would not have to reassess properties every three years. HB 581 puts a statutory requirement with penalties in place where all properties are required to be reassessed every three years. Currently, there is no statute in place that requires reassessments.

The Department of Revenue only “recommends” properties should be reassessed every three years. Currently, there is no penalty for not reassessing properties every three years.

Opting out will also remove the ability of the voters to choose a future local option sales and use tax to provide further property tax relief. This relief would be in the form of a millage rate rollback affecting all properties.

Many city limits traverse county lines. Some cities are in two counties or more, such as Baldwin, Alto, and Tallulah Falls. If any of those cities opt out, it would affect multiple counties and make those counties and cities ineligible to hold a referendum for the new local option sales tax for property relief.

“Voter nullification”

Former Mayor of Augusta Bob Young addressed the Augusta Commission last week during a meeting as city leaders contemplate opting out of the new law. He accused the elected officials of nullifying the voters’ wishes.

“I just don’t understand why anyone would consider taking the voices of 48,000 Richmond Countians and tossing them away, saying what you said doesn’t count. What you said doesn’t matter,” Young said. “That’s not voter suppression. That’s voter nullification,” he added.

The way he sees it, there is no need to hold public hearings. “There is no need to hold public hearings to opt out. The voters held the public hearing on November 5th when they approved our new homestead exemption,” Young said.

Young makes some key points about the voter approved statewide floating exemption. The exemption will preserve and promote home ownership. He references that UGA’s Terry College of Business has projected that the housing industry will lead economic growth in 2025. The projection has the number of single-family homes increasing by 9% this year.

He points out that the exemption does not restrict the government’s ability to collect taxes nor does it reduce the amount of money the government can collect.

To Young’s point, the new law does not restrict elected officials’ ability to increase the millage rate or budgets, both variables are used to factor property taxes. As government budgets increase, so does the need to increase the millage rate.

Why opt in?

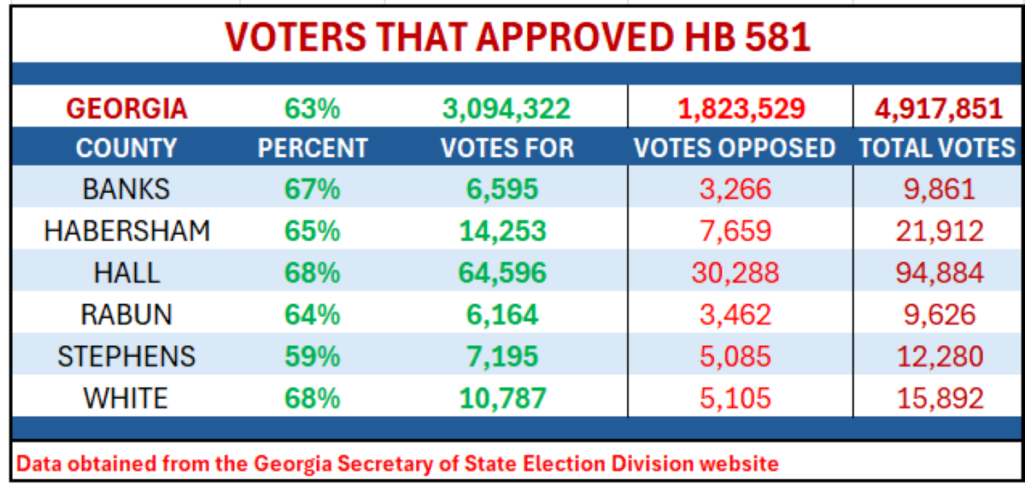

To answer the question directly, the voters said so. The simple fact is that 63% of voters across the state approved HB 581. Locally, in Habersham County, 65% approved the constitutional amendment for property tax relief.

SEE RELATED: Habersham cities set joint meeting to discuss HB 581

Local governments do not have to opt in. The law is written in such a manner that they are automatically in. By remaining in, those residential property owners that qualify for a homestead exemption can receive the statewide floating homestead exemption.

That exemption caps property valuations at the previous year’s inflationary rate as determined by the Georgia Department of Revenue (DOR). The DOR has determined that it will use the consumer price index (CPI) to factor the inflationary rate.

Tax relief

Opting in gives property owners two opportunities for tax relief. The first opportunity is the statewide floating homestead exemption by capping the inflationary rate on property valuations to the annual CPI. The housing market has seen extreme value inflation due to high demand for housing.

Nearly two-thirds of state and local voters have already opted in for this opportunity in November. The law only affords this form of property tax relief to residential owners that qualify for a homestead exemption. Industrial and commercial properties will not be eligible for the exemption.

The second opportunity for property tax relief will be up to the voters in the form of a new local option sales and use tax. This tax will be specifically and solely used, dollar for dollar, to reduce property taxes in the form of a millage rate rollback. This opportunity will come in the form of a referendum on a ballot sometime in the future. The new tax will benefit all property owners in the county and cities.

According to Georgia State Rep. Victor Anderson (R-Cornelia), the new tax is referred to as the Flexible Local Option Sales Tax (FLOST). During the 2024 legislative session, Anderson attempted to amend a statute that would have allowed a similar tax.

By staying in the provisions of HB 581, counties would be required to reassess properties every three years. This statutory requirement would provide consistent and fair assessments of all properties on a regular basis that has not been required in the past.

Additional benefits

For those counties and cities that receive the Local Option Sales Tax (LOST), property owners could also receive the FLOST tax for property tax relief. LOST collections are already used to rollback the millage rate for those governments. If voters approve a referendum for FLOST, they will receive an additional millage rate rollback on their property taxes.

Local leaders

The Habersham County Commission will discuss HB 581 during its work session on Tuesday, January 21. Following the work session, during its regular meeting, the commission will consider approving a resolution to not opt out of HB 581.

On Wednesday, January 22, Habersham County’s cities will have a joint local government meeting at the Community House in Cornelia. They will discuss the fate of HB 581 as it relates to their individual cities.