Reports of storm damage are coming in now from across Georgia. State insurance officials say they’re standing by, ready to help residents recover. (photo/WSB-TV)

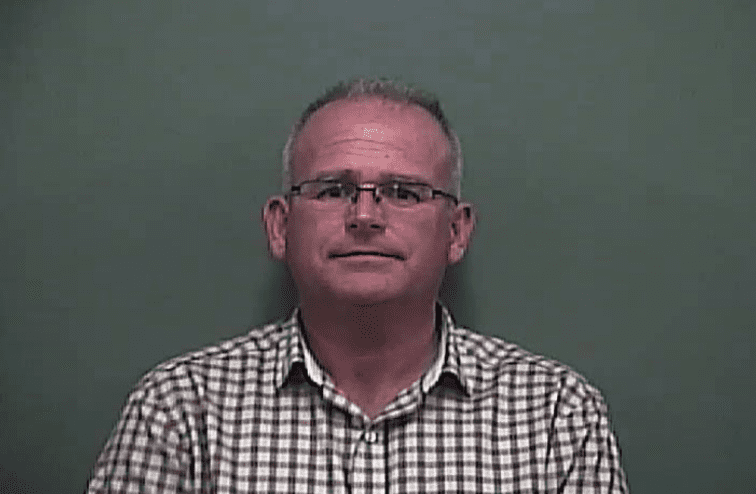

(Atlanta) – Insurance Commissioner Ralph Hudgens says his office stands ready to assist Georgia residents with any claims arising from Hurricane Irma.

His office has set up a toll-free claims assistance line and plans to have insurance experts in the area in the event of a storm.

“Policyholder can contact my Consumer Services Division toll-free at 1-800-656-2298,” Hudgens said. “Also, if Irma should cause significant damage, I plan to send claims experts to the affected areas for face-to-face consultations.”

In the meantime, Hudgens recommends that property owners make copies of their insurance policies, insurance company’s phone number and agent’s phone number; inventory their personal belongings, and keep all of these documents with them should they be forced to evacuate. The Commissioner also reminds property owners of the following tips in case of damage:

- Contact your insurance agent immediately if you have had damage to either your house or car; do not delay. Your agent should provide you with claims forms and arrange for an insurance adjuster to visit your property or look at your automobile.

- Remember in severe weather to drive with caution. Inclement weather does not absolve you of liability should you have an automobile accident. It is your responsibility to drive with a degree of caution warranted by hazardous conditions.

- A typical homeowner’s policy does not cover damage from flood waters. A separate policy must be purchased through the National Flood Insurance Program; contact your agent if you feel you need a flood policy. Remember, you must live in a floodplain, and your community must participate in the NFIP to qualify for this type of coverage. Coverage usually goes into effect 30 days after the policy is purchased. Unlike a typical homeowner’s policy, a mobile home policy may include flood coverage.

- Secure your property. For example, if your roof was damaged or blown off, or a tree has pierced the roof, cover the affected area with a tarp or plywood to protect your property from further damage. Keep receipts of materials used for repairs; your insurance company should reimburse you for repair costs.

- If the damage is so severe you have to leave, remove valuable items if there’s nowhere in the home to secure them.

- Remember, many insurance companies permit their claims representatives to write checks or issue debit cards for additional living expenses to policyholders on the spot. Contact your agent for details.

“The Department expects insurers to settle claims in a timely manner, and work closely with the Department to help individuals affected by this natural disasters,” said Deputy Commissioner Jay Florence.

If you have questions about your policy, or if you are experiencing difficulty reaching your company, call Commissioner Hudgens’ Consumer Services Hotline at 404-656-2070, or, outside the Metro area, 1-800-656-2298. Phone lines are open from 8 a.m. to 6 p.m., Monday through Friday.