“Corporate greed.’’

“Steering patients.’’

“No transparency.’’

Those phrases were used by Georgia lawmakers Thursday to characterize the complicated practices of pharmacy benefit managers. PBMs basically are corporate middlemen between health insurers or large employers and drugmakers in handling pharmaceutical benefits.

A trio of House bills aims to strengthen regulation and scrutiny over the PBMs. One bill, in fact, could lead to the removal of existing PBMs from the Medicaid program’s managed care business. That could cost those entities millions of dollars annually in Georgia.

The legislation, sponsored by Republican Reps. David Knight and Sharon Cooper was the primary focus of a Thursday hearing of the House Special Committee on Access to Quality Health Care.

The legislation, sponsored by Republican Reps. David Knight and Sharon Cooper was the primary focus of a Thursday hearing of the House Special Committee on Access to Quality Health Care.

And Friday, the panel voted to approve House Bills 918, 946 and 947. The state Senate is considering its own PBM legislation. (Here’s a recent GHN article on the PBM issue.)

The House panel Friday also approved revisions to surprise billing legislation, including addressing emergency care delivered in hospitals not part of a patient’s insurance network.

Nationwide concern

The PBM controversy is resonating nationally. The U.S. Senate is currently looking at these groups’ practices, with the Senate Finance Committee investigating their possible role in the skyrocketing cost of insulin.

PBMs make decisions on which medications will be placed on an insurer’s list of covered drugs, and how much the insurer will pay for them. The pricing often includes rebates paid by the drug manufacturer to the PBM, but that rebate isn’t passed on to the patient. When patients use their health coverage to fill a prescription, PBMs are involved in paying those claims and setting the amounts the consumers owe.

One extremely unpopular practice is PBMs’ steering of patients to pharmacies with which the groups are affiliated. Rep. Knight, of Griffin, said the recently enacted Georgia law against doing this has not changed PBMs’ behavior, and he is pushing legislation to beef up that law.

One extremely unpopular practice is PBMs’ steering of patients to pharmacies with which the groups are affiliated. Rep. Knight, of Griffin, said the recently enacted Georgia law against doing this has not changed PBMs’ behavior, and he is pushing legislation to beef up that law.

Increased transparency on PBMs is essential, Knight added. “It’s time to pull back the curtain and open the black box,’’ he said. Through the activities of PBMs, patients can be pushed toward expensive brand-name drugs, rather than less costly generic drugs, he added.

House Bill 946 would increase fines for steering violations and bar PBMs from paying affiliated pharmacies more than independent ones. The state insurance commissioner would get more authority to regulate PBM practices, and the legislation would require PBMs to pass along rebates to insurers. House Bill 918 would restrict onerous PBM audits of pharmacies.

Knight said Medicaid PBMs in Georgia gained more than $90 million over the past two years from ‘’spread pricing.’’ That occurs when PBMs keep a portion of the amount paid to them by insurers for drugs instead of passing the full payments along to pharmacies.

Rep. Cooper of Marietta, who chairs the House Health and Human Services Committee, said that PBMs’ actions force patients to experience delays in getting needed medications.

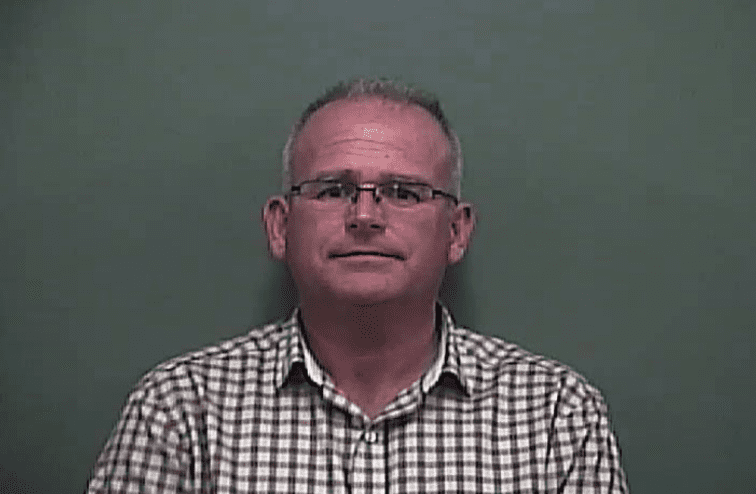

Knight

“Corporate greed is just out of control with PBMs,’’ said Cooper, “and it’s hurting our patients.’’

PBMs, she added, “have found ways to game the system. . . . They’re squeezing the very lifeblood out of our pharmacists,’’ especially in small towns in Georgia.

Pharmacists told the House panel that they often lose money on drugs they order for Medicaid patients, because it costs them more to obtain the drugs than Medicaid managed care companies pay them for the service.

Thomas Jusu, a pharmacist, testified Thursday that he had to close his East Lake pharmacy due to underpayments from Medicaid. “My second pharmacy is hanging by a thread,’’ he told lawmakers.

House Bill 947 would set up an independent actuarial study to determine savings if Georgia took the current PBM structure out of Medicaid managed care plans. If the estimated savings are more than $20 million annually, Georgia would “carve out” the PBMs from Medicaid managed care.

Knight noted a West Virginia study that found more than $50 million in savings when PBMs were eliminated from that state’s Medicaid managed care.

Sharply divergent views

Insurance and PBM officials defended their practices Thursday as an essential tool to lower health care premiums. Prescription prices, they said, are controlled by the drug manufacturers.

Scott Woods of a group representing PBMs, the Pharmaceutical Care Management Association, told lawmakers that pharmacy benefit managers manage drug coverage for 8.8 million Georgians.

Their negotiations and rebates help insurers offer affordable coverage, Woods said, adding that the pending legislation may not apply to large, self-insured employers.

“Transparency should include all parts of the supply chain,’’ including drug companies and pharmacies, Woods said.

Allan Hayes of America’s Health Insurance Plans, an industry group, said insurers use PBMs to negotiate prices with drugmakers.

But consumers and their representatives weighed in as well.

Leone-Glasser

Dorothy Leone-Glasser of the consumer group Advocates for Responsible Care said patients should not have to fight for access to affordable drugs.

Georgia must “choose patients’ health over profits’’ in clamping down on PBM practices, she said.

Heather Breeden of the National Multiple Sclerosis Society said many patients with MS face delays in getting medication due to PBMs.

And Anna Adams, a lobbyist for the Georgia Hospital Association, said she has MS and faces high costs for medications she needs.

Adams said programs such ‘‘co-pay accumulators’’ – under which drug manufacturers’ coupons cannot be applied toward patients’ deductibles or co-payments — “are harmful to patients’’ and can push people with some diseases into relapse.

The House panel heard testimony Thursday on changes to legislation on surprise medical billing. Rep. Lee Hawkins, a Gainesville Republican, said language was added on billing by non-network hospitals in emergency cases. Experts had said a previous version of the legislation included a loophole allowing such hospitals to ‘’balance bill’’ patients who get emergency care. (Here’s a GHN article on the loophole.)

The new version of House Bill 888 states that the non-network hospital “shall bill the covered person no more than such covered person’s deductible, coinsurance, co-payment, or other cost-sharing amount as determined by such person’s policy directly.’’

Surprise bills can devastate a family’s finances. A new NBC and Commonwealth Fund poll found that nearly half of likely voters (46%) with medical bill problems have used their savings — including money from their retirement fund — to pay these bills. The poll also found that more than one-quarter (28%) of respondents worry about receiving an unexpected or surprise medical bill over the next year.

Here’s a recent GHN article on a family’s billing problem from emergency care at a hospital outside their network.