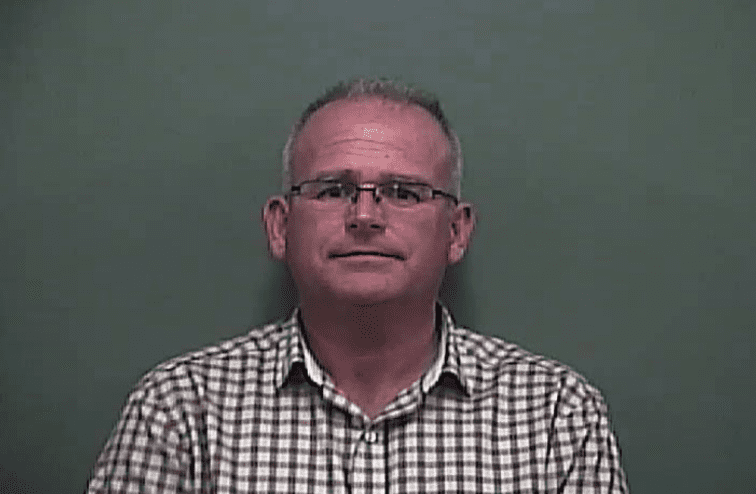

“Disappointed” and “shocked”. That’s how Brian Horton of Invest in Habersham describes his reaction to a joint press release from the leaders of the Habersham County Republican and Democratic Parties. In that release, GOP Chair Carl Blackburn and Democratic Chair Virginia Webb outlined their opposition to the county’s proposed 1% Transportation Special Local Option Sales Tax.

“It is sad to see representatives of both parties coming out and condemning local citizens (taxpayers) for merely advocating for improvement of the local roads and bridges via an additional 1-cent sales tax,” Horton says.

Invest in Habersham is a local political action committee (PAC) formed to promote the proposed sales tax increase. Paperwork filed with the county elections office lists Horton as chair. He tells Now Habersham the other committee members are James Stapleton Jr., Matthew Cathey, Alan Baker, and Mike Mixon.

Challenging the questioning

In his response to Blackburn and Webb, Horton challenges their questioning of the validity of figures that indicate 25-40% of the sales tax collected in Habersham comes from non-residents.

“While there is not a definitive method in place to track and quantify the exact ratio of County Resident vs. Non-County Resident sales tax revenue, this range is based on a number of data points,” Horton says. He cites 2016 data from the Georgia Department of Economic Development on direct tourist spending and county population statistics to support claims that a significant percentage of revenue from the penny-on-the-dollar tax would come from out-of-towners.

Horton also takes issue with Blackburn’s and Webb’s statement that advertisements for Invest in Habersham are “false” and “misleading” because they misrepresent the need for bridge repairs in the county.

“The County currently is responsible for maintaining 56 bridges. Of those 56 bridges, 11 have a sufficiency rating between 50 and 80 and are deemed in need of repair. 5 bridges have a sufficiency rating of less than 50 and are deemed in need of replacement. 2 bridges are deemed structurally deficient and are in need of replacement. 18 bridges in need of repair/replacement out of 56 total bridges equals 32%! That’s pretty straightforward math. Including the other 6 that are deemed functionally obsolete brings the percentage up to 43%,” Horton states.

Repaving

When the county commission called for the T-SPLOST vote back in July, county officials said Habersham is on a 40-year repaving cycle. That’s has been a major focal point for T-SPLOST supporters. Blackburn and Webb argued that matching funds from the Georgia Department of Transportation and revenue from the state gas sales tax should offset the need for a local tax increase. Horton disagrees, stating, “The additional sales tax revenue and matching Federal and State grants lower the re-paving cycle to 20 years by doubling the number of miles paved each year.”

The Invest in Habersham Chair also takes issue with Blackburn’s and Webb’s references to articles that speak favorably of the state of the state’s infrastructure. “These articles refer to the State and Federal highway system and make NO mention nor even pertain to our local roads or infrastructure,” he says.

Horton accuses Webb and Blackburn of “stoking fear in voters” by tying T-SPLOST to the anticipated SPLOST renewal vote two years from now.

“Passing this additional layer of taxes on our Habersham County citizens could jeopardize the important need to renew SPLOST (VII) in 2020,” the Party Chairs wrote in their joint press release. “The County most likely will need to pay for a new Habersham County Detention Center by then, a project we both whole heartily support!” Horton counters by saying, “that is a separate decision and has no bearing on the current Roads and Bridges SPLOST.”

Who will pay?

From the outset, county officials and tax proponents have suggested that if T-SPLOST doesn’t pass, property taxes will be raised. “A vote against the sales tax will lead to at least a 3-4 mil increase,” says Horton. “That’s roughly $270 per year increase on a $150K home.”

Sales tax supporters call it a “fair tax” because it would spread costs among all county residents (and non-residents who shop in Habersham) and shift the burden away from property owners. “Roads and Bridges will have to be repaired and replaced plain and simple,” says Horton. “Habersham County is in the 8thpercentile in lowest taxes levied per capita out of 159 counties in the State. There are few counties in GA with a lower cost of living in regards to property taxes than right here.”

Horton concludes his rebuttal with an appeal.

“We are local business people, parents, and church members working to find a solution to an evident problem,” he says of the Invest in Habersham PAC. “Regardless of your personal opinion, the most important thing is that YOUR voice is heard. Go Vote.”

Read Carl Blackburn and Virginia Webb’s full joint release here

Read Brian Horton’s full response here