Last month, there were at least four roadway accidents involving Habersham County vehicles within the course of 11 days. And while insurance premiums paid by the county have spiked since 2020, officials have sought proactive measures to minimize risks in hopes of mitigating claims.

Members of multiple departments within Habersham County’s government also say the matter as a whole is far more complex.

By the numbers

County documents indicate that Habersham filed just over $840,000 in claims for auto/property damage from 2021-2023, and while this number peaked in 2021 ($510,737), the figure then saw a significant decline ($47,597) last year.

Since Habersham County is self-insured, claims covered must meet the deductible limit of $5,000.

Still, overall, just over 64 automobile claims over the last five years have amounted to a total of more than $1.14 million.

And, on average, Habersham County’s casualty and liability insurance premiums have seen a 97% increase since fiscal year 2020/2021, according to county documents, with a notable spike from $471,662 in FY 2022/2023 to $617,262 in FY 2023/2024.

For FY 2024/2025, the county’s bill for liability insurance was up to $728,164.

Officials say much of these increases have come after new construction and vehicle purchases by the county extended the list of items that had to be insured. And officials were able to cut some costs through a “safety discount” for actions the county has taken to prevent future risks.

“This is an 18% increase over the 2023/FY24 invoice after the unexpected 7% safety discount we got when we got the bill,” Habersham County’s Chief Financial Officer Tim Sims said. “The safety discount came about due to the hiring of the risk manager and setting up additional safety protocols and the new safety committee (safety solutions team) to review incidents and give recommendations on how to avoid incidents in the future.”

Also, for context, Sims noted that insurance costs across the nation increased 55% on average from 2019 to 2024.

“Ours is a bit higher than that,” Sims said. “We have a couple of new buildings that are insured during this time with new equipment, fire engines, and vehicles that have been replaced, bringing our values up.”

Other factors

Other contributors to higher premiums, as cited by county officials, include: general inflation, a larger number of employees and “exposure factors” specific to various departments. And then there’s the underwriters, who set the premiums and who often use complex formulas – they don’t have to explain – to determine these figures.

Now, according to county documents, the projected premium the county is expected to pay in 2025 is $905,351 – a 24% increase.

“There isn’t really a way for us to quantify how much any one particular incident, property, piece of equipment or exposure risk affected our premium,” Habersham County spokesperson Rob Moore said. “The entirety of this information is taken into account by our insurance companies’ underwriters.”

Officials also pointed to the decision to hire Risk Manager Tori Williams, who’s paid an annual salary of $63,440 to minimize risks, as a primary example of proactive steps taken by the county. Williams’ role as a risk manager is to assist the county in maintaining compliance with regulations, among other duties such as implementing strategies to decrease the probability of risk.

“Hiring a risk manager is a strategic move for an organization aiming to protect assets and personnel, minimize potential loss and achieve long-term sustainability,” Moore said. “A risk manager helps identify potential threats across various business areas and implements strategies to prevent these risks from impacting an organization. By preventing incidents, a risk manager can save an entity significant money.”

Williams has since sought to implement a range of policies to minimize risks, including future accidents, across all departments.

Recent accidents

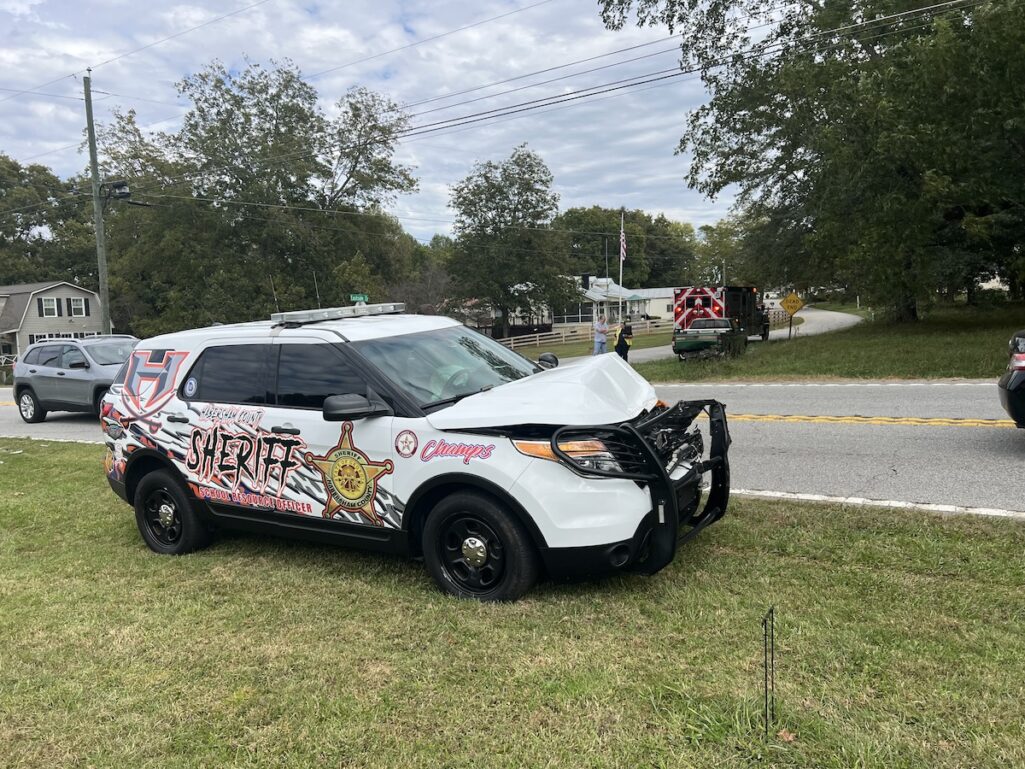

In October, there were four accidents involving county vehicles within a two week timeframe. The separate incidents involving Habersham County vehicles include:

- On Oct. 12, Georgia State Patrol determined a Habersham County deputy “failed to use proper due regard” when he performed a left turn on GA 17 and collided with a Mazda CX-5. The deputy suffered a broken arm during the wreck.

- On Oct. 15, a deputy rear-ended a pickup truck attempting to turn left onto Eastside Drive from Hwy. 441 in Demorest.

- On Oct. 15, a Habersham County patrol vehicle collided with a deer on a roadway and caused minor damage to the vehicle’s push bumper.

- On Oct. 23, a county dump truck swerved to avoid a vehicle and struck a pickup truck, though there were no injuries and the damage was minor.

Response

County officials say all factors need to be considered before conclusions are made by the public.

Deputies will continue to complete annual training both behind the wheel and on a simulator to minimize accidents and ensure public safety, according to Moore.

And, Moore noted, Habersham’s patrol deputies “travel anywhere from 3,000 to 3,500 miles per month each, equaling anywhere from 36,000 to 42,000 per deputy each year.”

Moore said the number of patrol cars on the road at once can vary from as few as four on weekends and up to as many as 20. There also are court personnel, special operations units, transport units, school resource officers and others on the road in county vehicles.

“The deputies (involved in accidents) were not cited by the Georgia State Patrol but were or will be disciplined by the sheriff’s office,” Moore said in an email. “Every deputy that is involved in a wreck and is deemed to be at fault faces disciplinary action.”

That disciplinary action can range from days off without pay, loss of a take-home vehicle or even termination, according to Moore.

“It should be noted that having a write-up in an employee’s file affects whether that individual is eligible for a merit raise,” Moore said.

Across departments, Moore went on to say deputies could travel more than 1 million miles a year, increasing the likelihood of a possible accident.

“Just because you work in law enforcement does not make you less susceptible to accidents. Our deputies operate out of their vehicles for at least 12 hours at a time, often being called upon to go to emergency calls on opposite ends of the county,” Moore said.

He added: “We always have safety as our top priority, but by our nature, human beings make mistakes. When that happens, we address those mistakes and move on because the law enforcement needs of Habersham County do not stop because of one incident.”

In a statement to Now Habersham, Habersham County Commission Chairman Ty Akins said commissioners continue to be “committed to maintaining safe operations,” no matter the circumstances.

“While we are not able to prevent all accidents, we work to create a safe environment for our employees and the public,” Akins said. “…regarding the sheriff’s office, we work with the sheriff to provide that office with an approved budget, and we try to support them as best we can, but our involvement starts and ends with that process.”

Sgt. Phillip Young, an officer on Habersham County’s Highway Enforcement of Aggressive Traffic, called on all motorists to practice safe driving behaviors to minimize risk for both the county and the public. On Nov. 8, a deputy’s stationary patrol vehicle was allegedly struck by a passing driver on Ga. 365 near Alto.

“Make time to drive safely, do not attempt to exceed the speed limit to be on time for an event or work,” he said. “Speed is one of the most common contributing factors to motor vehicle crashes in Habersham County. Speeding on our roadways is completely preventable. We carry out several campaigns throughout the year such as our Southern Slow Down campaign to advocate voluntary compliance to speed limits.”

Now Habersham reporter Jerry Neace contributed to this article