Law enforcement is warning of another IRS phone scam. Scammers identifying themselves as IRS agents are calling people and telling them they’ll be arrested if they don’t pay to settle their taxes.

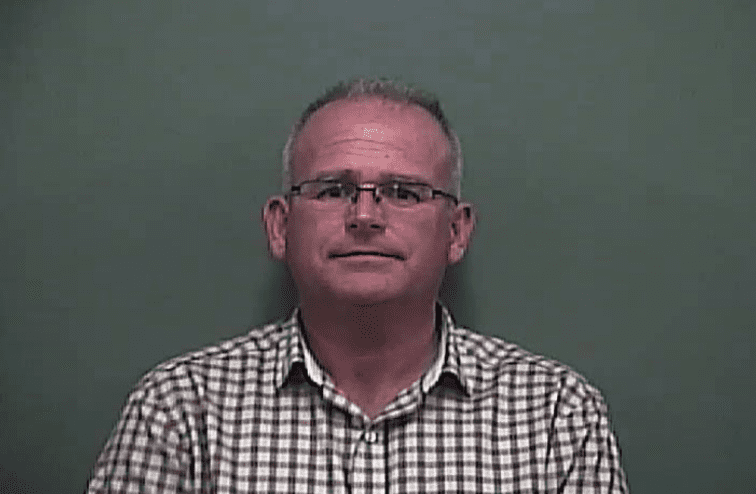

The Habersham County Sheriff’s Office (HCSO) says some county residents have received the bogus call. So did Officer Kyle Roder with the Eau Claire Police Department in Wisconsin. He turned the scam around on the scammers.

The viral video has been viewed over 10 million times since it was posted in March.

How to protect yourself against scammers

IRS scams are fairly common and have been around for a long time. The IRS says that “in recent years, thousands of people have lost millions of dollars and their personal information to tax scams and fake IRS communication.”

“…IRS does not threaten taxpayers with lawsuits, imprisonment or other enforcement action.”

A section of the IRS website is dedicated to helping taxpayers identify scams. The IRS stresses it doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. “In addition, IRS does not threaten taxpayers with lawsuits, imprisonment or other enforcement action,” it says.

Recognizing the telltale signs of a phishing or tax scam could save you from becoming a victim.

“If you receive a phone call from someone who claims to be from the I.R.S please do not give them any information, hang up the phone, and call the I.R.S. directly to ask them if there is an issue involving your taxes,” HCSO urges in a recent Facebook post.

IRS debt collectors are legit

With all of the scams out there it can get confusing as to who and what is legitimate when you’re contacted by someone claiming to be with the IRS.

Keep in mind, the IRS is again using debt collectors to recover overdue taxes. The practice was stopped in 2009 but Congress passed a law in 2015 to restart the program.

Four private collection agencies are approved to collect overdue taxes for the Internal Revenue Service. They are CBE Group, ConServe, Performant, and Pioneer.

Before an account is turned over to collections, the taxpayer will be notified by mail. The IRS will send a letter followed by a letter from the private debt collection agency.

Private debt collectors will not ask for payment on a prepaid debit, iTunes or gift card.

If you have questions or concerns about anyone requesting private information or payment to the IRS, do as the Habersham County Sheriff’s Office advises and contact the agency directly. A helpful resource is “How to know it’s really the IRS calling or knocking on your door” which can be found on the agency’s website.