The Habersham County School System will opt-out of House Bill 581 – a statewide floating homestead exemption that caps the annual increases in property values as a form of tax relief. And, during a first public hearing over the bill Thursday afternoon, school officials said they have good reason to do so.

Members of Habersham’s Board of Education and school officials explained their reasoning for opting-out, citing a significant and potentially negative long-term impact on county schools.

Factors

During the hearing, Chief Financial Officer Staci Newsome told board members HB 581 would strip Quality Basic Education (QBE) funding – an average total of $61 million annually – from Habersham’s schools.

“Our BOE funding is significantly different from cities and counties,” Newsome said Thursday. “…the board (of education) has also lowered the millage rate for the last 10 years in a row – and has a goal to keep property taxes low for everyone in our county.”

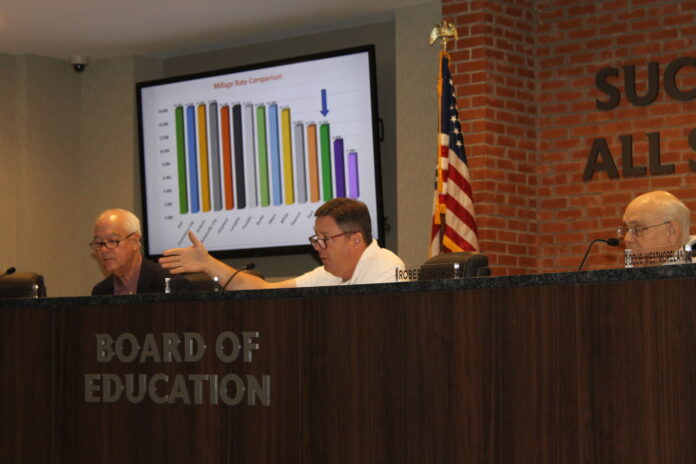

A graph displayed during the hearing indicated Habersham County’s School System has reduced the millage rate by 4.136 mills (from 14.490 to the current rate of 10.354) since 2015.

A mill is equal to $1 per $1,000 in taxable property value. And in Habersham, the school system taxes property at 40% of its value.

Habersham County School System’s millage rate, despite being the third largest system of 14 other surrounding systems, is the third lowest of all schools in the Pioneer RESA region.

Kerry Anderson, one of three residents to attend the hearing, was the only speaker to ask a question specific to the bill.

“Once you choose to opt-in or out, is that forever? Or will you have a chance to reevaluate it?” she asked.

Without a sunset clause, Habersham County Board of Education Chairman Russ Nelson explained that there’s only “one shot at opting in.”

“When you opt in, you’re in forever,” Nelson told Anderson. “The problem with that is – there are a lot of unknowns that come down the pipeline that we just don’t know about.”

Though HB 581 was approved by a majority of Habersham County voters by referendum last November, the school system’s decision to opt-out does not influence whether the bill will move forward. Instead, HB 581 only can proceed toward an additional 1 cent sales tax (FLOST) if all seven of Habersham’s cities and the county agree on the measure.

If HB 581 moved forward, and FLOST were approved by voters, the Habersham County School System could not receive revenue collected from the sales tax. And, under HB 581, potential lost revenue for the school system could instead result in a possible millage rate hike.

Nelson went on to say that board members are in talks with the county to consider raising the exemption threshold for seniors above $12,000.

“We have begun those conversations,” he said. “…once this is settled here, we are going to have that conversation – to get that limit up for seniors.”

Doug Westmoreland, a member of the board, said he voted in favor of HB 581 on the ballot – though he recognizes the adverse impact he said it would have on Habersham’s schools.

“We’ve got an awesome school system here. One of the best in the state, and as long as I’m on the board, I’m going to do everything possible to keep it that. And if it means to opt-out of this bill because it helps our students, that’s what I’m going to do,” Westmoreland said, stating that the homestead under Habersham schools is stronger than one that would be provided under HB 581.

A second public hearing will take place at 4:30 p.m. Thursday, Feb. 6, at the Central Office Annex Building, located at 144 Holcomb Street in Clarkesville.