The Habersham County School System became the first government entity to opt-out of a property tax relief bill approved statewide by voters on Monday, Feb. 10.

After a third and final public hearing Monday, the Habersham County Board of Education unanimously approved the resolution to opt-out of House Bill 581 – a statewide floating homestead exemption that caps the annual increases in property values as a form of tax relief.

The decision came as school systems across the state have taken a similar path in electing to opt-out.

The bill can still move forward and bring tax relief to property owners despite the decision by board members. HB 581, as written, only requires all seven of Habersham’s cities as well as the county to proceed toward FLOST – also known as a Flexible Local Option Sales Tax – a 1 cent sales tax which would have to be approved by referendum by a majority of voters.

Chris Webb was the only resident to speak during the public hearing Monday, pleading for board members to consider the impact skyrocketing home values have had on property owners in recent years.

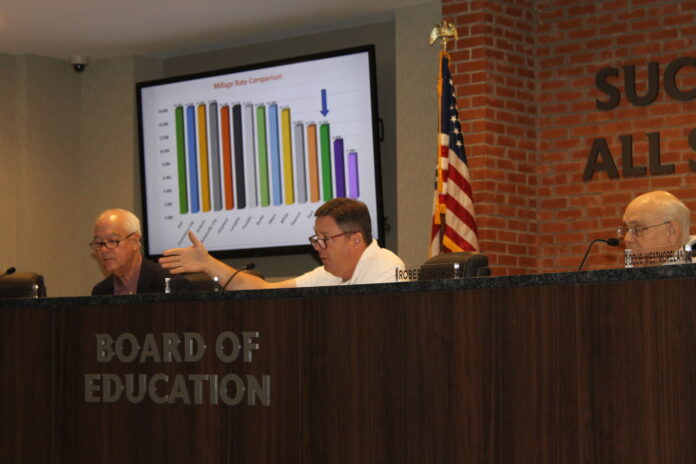

After noting HB 581’s approval by a majority of Habersham County voters in November, Webb alluded to a graph displayed during the hearing which showed Habersham schools have reduced the millage rate by 4.136 mills (from 14.490 to the current rate of 10.354) since 2015.

A mill is equal to $1 per $1,000 in taxable property value. And in Habersham, the school system taxes property at 40% of its value.

The Habersham County School System’s millage rate, despite being the third largest system of 14 other surrounding systems, is the third lowest of all schools in the Pioneer RESA region.

“I think, overall, we the people spoke pretty loud and clear,” Webb said. “We all agree we’re overtaxed…our millage rates have gone down, but our actual property taxes have not gone down because of the values of our properties.”

Webb concluded by urging board members to look at other bills across the state to find ways to bring property tax relief to county residents.

Factors, reasoning

Members of Habersham’s Board of Education have sought to explain their position on the bill since public hearings began on Thursday of last week, citing what they believe could be significant and potentially negative long-term impacts on county schools.

Throughout the hearings, Habersham School System’s Chief Financial Officer Staci Newsome has said HB 581 would strip Quality Basic Education (QBE) funding – an average total of $61 million annually – from Habersham’s schools.

But a key sponsor of the bill, Georgia State Rep. Victor Anderson (R-Cornelia) has disputed these claims and emphasized his belief that HB 581 would not bring any reduction in QBE funding.

And though Anderson expressed confidence the bill wouldn’t significantly impact revenue of Habersham’s schools, Chairman Russ Nelson pointed to factors – such as uncertainty, potential revenue loss, limited communication about the bill and unexpected expenses from state mandates – that influenced the board’s decision.

Under HB 581, if FLOST were to move toward approval at a later time, the school system could not collect any of the revenue.

Still, Habersham County is one of only eight counties in Georgia where the school system for years (since the 1980s) has received all LOST (Lost Option Sales Tax) revenue, which none of the cities in the county collect.

Board members address public

Toward the end of Monday’s meeting, board members doubled down on the vote to opt out, with Nelson again reiterating the barriers in communication he said have existed throughout the process.

“It is not an easy decision to make because the information is not easy to get, and is, sometimes, not correct,” he said. “…there were a lot of answers we definitely couldn’t get, and we had to make the best decision for the children.”

Board member Doug Westmoreland noted that while a majority of voters approved the bill in a referendum last November, provisions in HB 581, as written, in fact allow school systems to opt-out statewide.

“That’s part of the bill,” Westmoreland said. “It didn’t say we had to (opt-in) – that was an option we could do. We need to do it for the best interest of our students.”

Last week, Anderson indicated that members of Georgia’s Legislature are “fast-tracking” a new bill to extend the deadline for government entities to decide whether to opt-in until 2029.