If you own property in Habersham County tax day is coming early this year. The county commission approved a resolution Monday permanently moving the property tax due date from December 20th to November 15th.

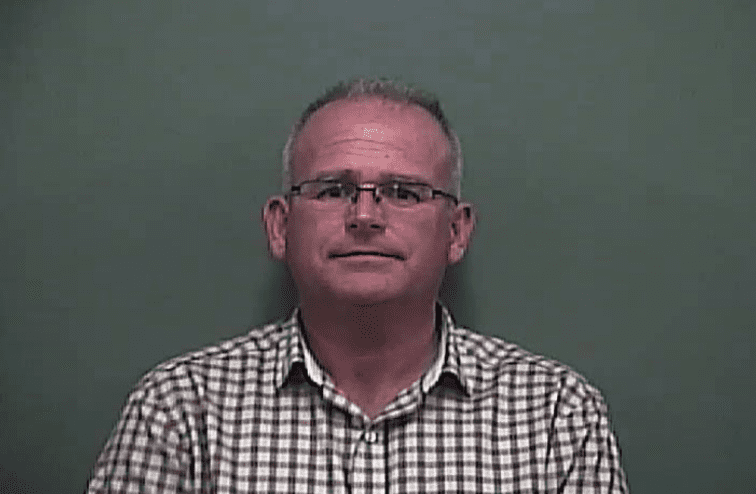

Habersham County Tax Commissioner June Black-Warren requested the change back in February. She says the main reason she requested it is because taxpayers complain about the current due date (Dec. 20) being right before Christmas.

“The only date that has changed is the property tax deadline,” says Black-Warren. “The bills will be mailed the first week in August, as usual. State law requires we allow 60 days for payment. However, we mail early to give taxpayers time to make payments or prepare to pay in full by November 15th starting this year.”

Black-Warren says property owners may start making payments as soon as the bills are mailed. “We will send out late notice December 1st with intent to FIFA (file a tax lien) for those who did not pay,” she says. “We will file FIFAs 1st of January and start getting ready to sell about mid-January.”

Many neighboring counties, including Stephens and White, made the change years ago. They report their collections are up since taxes are now paid before Christmas.

Black-Warren says she feels now is the right time to make the change in Habersham. “With collection rates at over 97% for 2017 and over 99% for prior years, Habersham County Residents are ready for a positive change and I honestly believe this will be a positive change for all of us.”

And that includes her staff.

“My staff couldn’t have Christmas as no one could be off and we were all so stressed by the time the December 20th deadline came, we were just ready for Christmas to be over too. No way to live. Now, we should be able to enjoy the season along with everyone else!”

Tax Commissioner Black-Warren says despite the change, there will be no grace period this year for delinquent taxpayers. “Taxes are something that we pay every year. We are publicizing and making the public aware,” she says. “We didn’t change the laws regarding interest and penalties. If they are not paid timely, interest and penalties must be calculated in accordance with the laws by which we are governed.”