Habersham County is beginning early preparations for a new Special Purpose Local Option Sales Tax (SPLOST 8), with plans to place it on the ballot in November 2025.

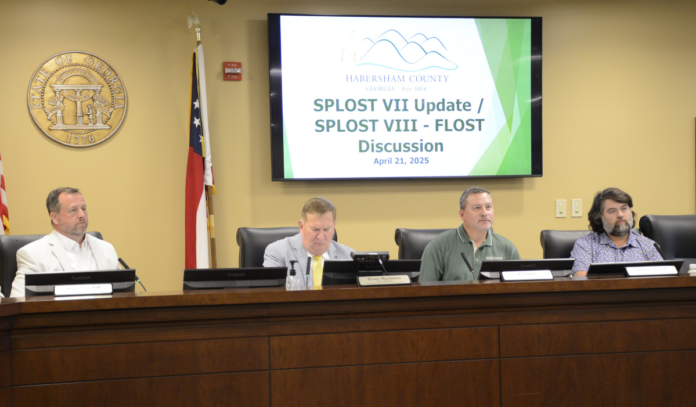

During a work session on Monday, April 21, County Manager Tim Sims provided the Board of Commissioners with an update on the current SPLOST and outlined the necessary steps for moving forward with the next round of funding.

SPLOST is a voter-approved 1-cent sales tax used to fund capital projects, ranging from public safety vehicles to major infrastructure improvements. SPLOST 8 would not take effect until April 2027, when the current SPLOST ends. The county must begin negotiations with local municipalities by next month to stay on track for the November 2025 referendum.

The Commission reached a consensus to proceed with placing SPLOST 8 on the 2025 ballot. If the measure fails, commissioners would have the option to bring it back before voters in November 2026.

Key steps ahead include creating a detailed project list and finalizing a revenue-sharing formula with the county’s seven cities. If the revenue is distributed based on population, SPLOST 8 would be in effect for five years. An intergovernmental agreement using an alternative formula would extend it to six years.

A six-year SPLOST 8 could generate approximately $56 million, with the county projected to receive about $39 million. The remaining $17 million would be shared among the cities.

The official call for the referendum is expected by August to meet the timeline for the November 4, 2025 election.

The purpose of moving forward with SPLOST 8 is to alleviate pressure on the general fund and property taxes. Many of the capital projects are paid for using SPLOST dollars and not property taxes. For example, SPLOST pays for a majority of public safety vehicles and equipment as well as road paving projects.

In addition to SPLOST 8, the Commission is also considering introducing a Flexible Local Option Sales Tax (FLOST) for a potential vote in 2026 or 2027, depending on the passage of SPLOST 8.

FLOST was made possible by HB 581 and is a similar 1-cent sales tax, but with a key difference. Revenues must be used specifically to reduce property tax millage rates. It must be reapproved by voters every five years.

According to data provided by the county, an equitable split of FLOST revenue could reduce the county’s and the cities’ millage rates by as much as 4.385 mills.

Commissioners expressed support for advancing SPLOST 8 now and following up with FLOST at a later date.