Citizens have been warned by elected officials in Habersham County that growth is coming – whether citizens want it or not. Little has been planned to actually control the growth once it gets here. Unfortunately, when developments reach a community, it’s often too late to control it.

The cost of providing for the aspects of growth is difficult to plan. For example, providing water and sewer infrastructure, providing roads, police, fire, and recreation facilities, to name a few, can be costly endeavors for local governments.

Growth

Over the last few years, Habersham County and its cities have had discussions about preparing for the pending growth coming to the area with the main topic being the inland port in Hall County that is just mere miles away from the south end of the county.

The growth from that development will impact not just Hall County but the region as a whole. As growth from metro Atlanta sprawls towards northeast Georgia, now may be the time for Habersham County and its cities to look at impact fees, not incentives or concessions.

Impact fees are designed to defray the cost of improving, expanding, or building new infrastructure or facilities. It is designed to not pass that total cost onto existing taxpayers in a community as a result from growth.

The catch phrase is “smart growth,” although no one has yet said what that exactly looks like for Habersham County or in each city. No matter the catch word or phrase, growth in any manner costs money.

SPLOST projects

Habersham County has struggled the last three years to have enough revenue to start building the SPLOST projects approved by voters in 2020. The situation has become so dire, it was suggested in 2023 by County Manager Alicia Vaughn that the commissioners consider creating a Public Facilities Authority in an effort to pay for those projects.

The SPLOST projects do not benefit just one segment of the county. They benefit the whole county. Whether it is a new 911 center or a new animal control facility, every citizen in the county benefits directly or indirectly.

The reality is many have lived in the community for several years and have paid taxes and paid their proportionate share. Those that recently moved in, have not paid their proportionate share of taxes but benefit from the infrastructure and facilities that already exist.

So, when a local government has a revenue issue, who do they turn to? In many cases, the taxpayers.

Now may be the time for elected officials to implement an impact fee schedule in Habersham County for new developments. Those developments could defray the costs of needed infrastructure improvements. According to the Association of County Commissioners of Georgia (ACCG), development impact fees provide an alternative to raising taxes on existing residents to accommodate new growth and new residents.

Many organizations oppose impact fees stating that the fees drive up the cost of affordable housing. The same argument could be made about real estate commissions.

According to a survey completed by Jon Stubbs with Clever Real Estate, the average real estate commission in Georgia is 5.81% of the selling price of a home. The average home sale price in Georgia is $327,174. The commission on that property would be $19,009.

Impact fees

For those communities that have impact fees, the fee for a new single family home is much less than what the real estate commission fee would be in all cases.

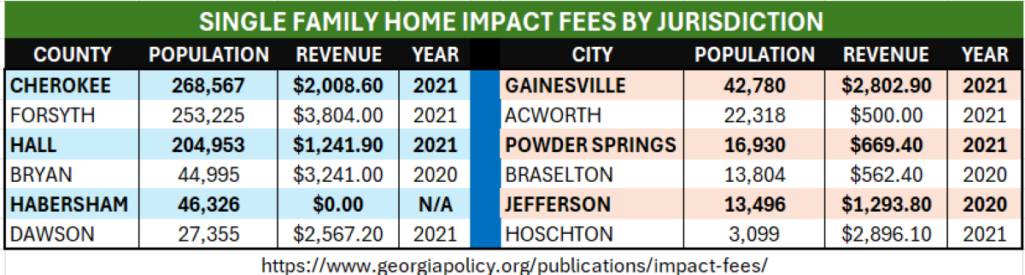

The table below demonstrates the impact fee for cities and counties for a single family home. Those costs vary due to the amount of new developments in that jurisdiction and the infrastructure needs to support those developments.

The closest county to Habersham County that has impact fees is Hall County. In the unincorporated area, those impact fees are $1,241.90 per single family structure. However, in Dawson County, it is experiencing tremendous growth. It is having to expand its infrastructure at a faster pace. Its impact fees for the same single family home is $2,567.20.

The closest county to Habersham County that has impact fees is Hall County. In the unincorporated area, those impact fees are $1,241.90 per single family structure. However, in Dawson County, it is experiencing tremendous growth. It is having to expand its infrastructure at a faster pace. Its impact fees for the same single family home is $2,567.20.

Based on the table, the average county impact fee for a single family home is $2,143.78.

Habersham County

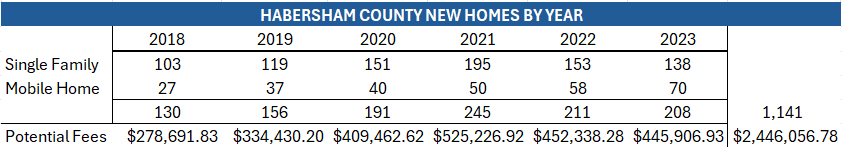

According to the Habersham Count Planning and Development Department, new single family homes are on the rise in Habersham County. Over the last six years, the county has had 1,141 new homes added. The table below shows the breakdown by type and by year. The table also shows the potential impact fees the county could have collected by using the average impact fee for those structures.

The fees collected would not pay for any singular project and by law, it can’t. The fees would be split by a committee that determined the various infrastructure components. Typically, those components are roads, recreation, fire, public safety, and law enforcement. Those fees can be used to offset the costs for infrastructure improvements or expansion.

The fees collected would not pay for any singular project and by law, it can’t. The fees would be split by a committee that determined the various infrastructure components. Typically, those components are roads, recreation, fire, public safety, and law enforcement. Those fees can be used to offset the costs for infrastructure improvements or expansion.

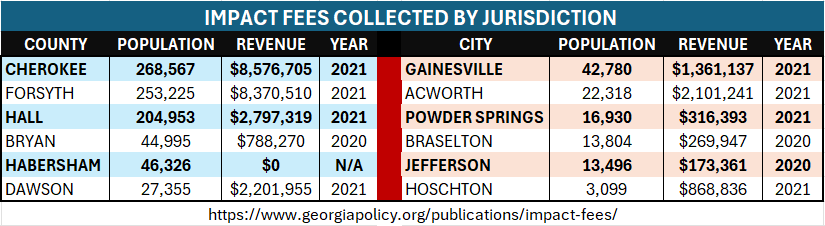

The table below shows how much each jurisdiction collected in a particular year from impact fees. The total amount includes all developments including residential, commercial, and industrial.

Hall County collected $2,797,319 in impact fees in 2021. In the same year, Dawson County collected $2,201,955. More information about impact fees in other jurisdictions can be accessed here.

Hall County collected $2,797,319 in impact fees in 2021. In the same year, Dawson County collected $2,201,955. More information about impact fees in other jurisdictions can be accessed here.

Impact fees are used for infrastructure improvements in developing areas. It is used to offset road improvements in a developing area. It can be used to build and equip a new fire station in that same area or pay for upgrades at a 911 center.

Drawback

There is one drawback to consider prior to approving an impact fee schedule. It will apply to any and all growth in the community. For example, an existing business that has been in a community for 50 years wants to build a new warehouse. That business would have to pay an impact fee for that new structure. The same is true for a family farm. Should a family member want to build a house on that farm, they would have to pay an impact fee. Also, impact fees are separate from any building permits or fees.

With budgets increasing year over year and taxes increasing for existing property owners, impact fees could be a revenue source that may need to be explored to help defray the cost of adding infrastructure. By doing that, there would be less dependence on existing property owners to pay for the growth that is coming.