House Bill 581 has been a topic of discussion over the last week for local officials. HB 581, known as the Property Tax Reform and Relief Act, went into effect on January 1. All taxing jurisdictions are automatically in the Act. However, the Act offers a provision to opt-out as long as the taxing jurisdictions follow the opt-out provisions before March 1.

There are three taxing jurisdictions within Habersham County that affect property owners depending where the property is located. Those are the county, the Board of Education (BOE), and a city.

All properties are taxed by the county and the BOE. If the property is within a city’s corporate limits, then it is taxed by the county, the BOE, AND the city the property is located in.

Habersham commission

Habersham County is intending to opt-in to the Act. According to county documents, the commission will be considering a resolution to opt in to the Act for property tax relief during its meeting on January 27.

Habersham BOE

Conversely, the Habersham County Board of Education intends to opt out of the Act. The BOE announced Friday, Jan. 24, in a press release of its intention to opt out of the bill. It will hold three public hearings in the coming weeks to receive public input of its intentions to opt out.

SEE RELATED: Habersham School System to opt-out of tax relief bill

Habersham cities

The cities of Habersham County met for a joint meeting Wednesday afternoon to discuss opting in to HB 581. The new law gives local governments the opportunity to opt out. However, to opt out, local governments must advertise and hold three public hearings, pass a resolution opting out, and submit paperwork of the same to the Secretary of State Office by March 1.

The meeting was attended by more than 50 elected officials, managers, and citizens. Most of the cities had a quorum of their elected body on hand should they decide to pass a resolution at the end of the meeting.

Phil Sutton of Sutton Consulting, LLC provided a presentation to the elected officials and answered questions about the floating homestead exemption and the flexible local option sales tax.

After the presentation, the cities’ elected officials began discussing how to move forward with the law. Baldwin Mayor Stephanie Almagno asked for a consensus among the cities of who was opting in? Baldwin’s council passed an opt-in resolution during the meeting, demonstrating their commitment to the new law.

Uncertainty

All of the cities, with the exception of Tallulah Falls, committed to opting in. Tallulah Falls did not have a quorum of its council present at the meeting Wednesday evening. According to Mayor Mike Early, the council is waiting to see if the cities of Rabun County will opt out before making a final decision.

When asked how soon Tallulah Falls could know its position, Early stated he was unsure. The remaining cities pressed Early to find out the council’s position over the next week due to the March 1 deadline to opt out. After the meeting, Early reiterated Tallulah Falls position for property tax relief. “We don’t yet have a similar consensus like we now have from Habersham and it’s cities,” he said.

However, the Cornelia delegation stated that they were committed to opting in as long as all of the cities opted in. However, if one city opted out, they would as well. Cornelia has already held one public hearing. The city has scheduled its second public hearing to opt out at its February 4 commission meeting.

After the meeting, Baldwin Mayor Stephanie Almagno gave her perspective about the opportunity to provide tax relief to Baldwin’s property owners. “HB 581 will help owners of homesteaded properties with their property tax bill,” she said. “And if signing on to HB 581 can help to limit the tax burden, especially for people on a fixed income, then we must do it.”

Bill intent

The intent of HB 581 is to provide property tax relief for property owners and reform the assessment process and notification for property taxpayers.

The bill provides two forms of property tax relief for homestead eligible properties. However, local governments must opt in in order to provide both forms of property tax relief.

The property tax reform requires counties to reassess properties every three years. It also requires that assessment notifications include what the millage rate rollback rate would be for current year property taxes, not the previous year’s millage rate. It also reforms the appeals process.

The first form of property tax relief is the valuation cap. Homestead eligible properties would be capped at the consumer price index for inflation and not the market inflationary rate. The second form of property tax relief would be up to the voters in the form of a referendum to approve a new local option sales tax. The new tax would be used, dollar for dollar, to be applied to rollback the millage rate.

Effects on taxpayers

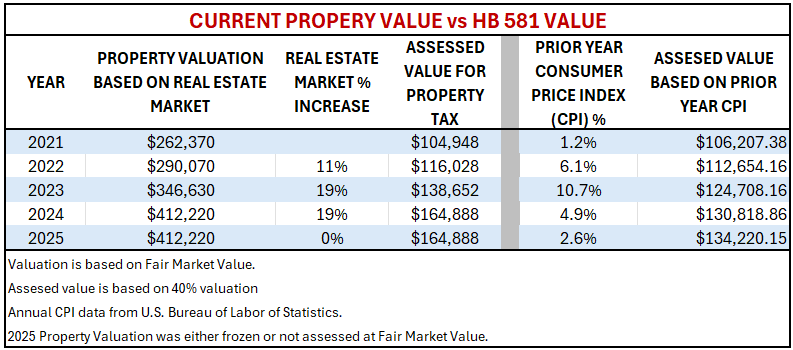

Opting in to the property tax relief act benefits the taxpayers of homestead exempt properties by capping the property valuation increase to the consumer price index (CPI) each year.

Over the last five years, property valuations have increased significantly year over year. By capping the valuations to the CPI, the property valuation increase would not be subject to real estate market inflation increases caused by demand. This portion of the law only effects homestead eligible properties.

Over the last five years, property valuations have increased significantly year over year. By capping the valuations to the CPI, the property valuation increase would not be subject to real estate market inflation increases caused by demand. This portion of the law only effects homestead eligible properties.

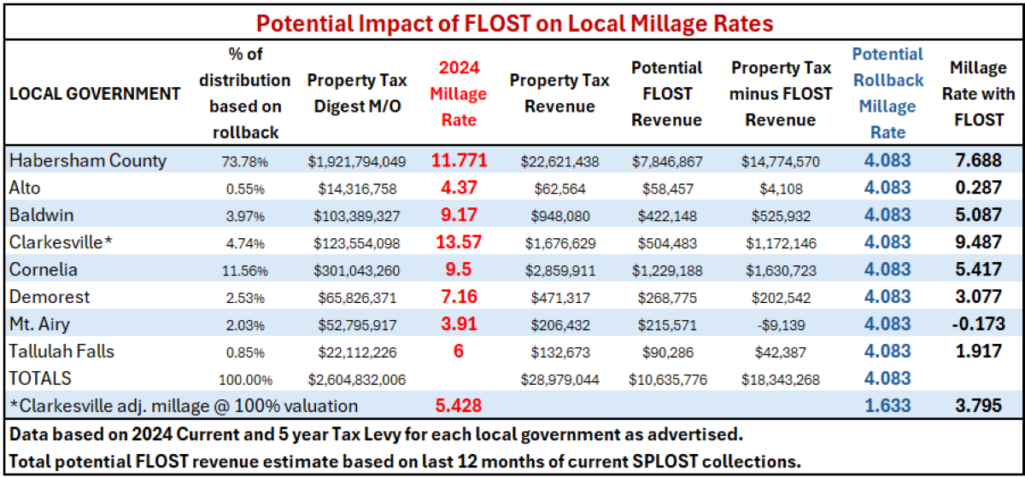

The second effect would be determined by the voters. Once the local government has opted in, a referendum could be presented for a local option sales tax. If approved, funds collected from the new tax would be applied to rollback the annual millage rate.

SEE ALSO: What is LOST?

The new tax can not be used as a revenue generator for the local government. By law, it must rollback the millage rate each year that the tax is in effect. This would effect not only homestead eligible properties but ALL properties.

Should voters approve the new local option sales tax, according to Sutton, Habersham County and its cities could reduce their millage rates by nearly 4 mills. For the cities of Mt. Airy and Alto, that means that their millage rate could be reduced to near zero for their city taxes.

Should voters approve the new local option sales tax, according to Sutton, Habersham County and its cities could reduce their millage rates by nearly 4 mills. For the cities of Mt. Airy and Alto, that means that their millage rate could be reduced to near zero for their city taxes.

Opting out

What’s the benefit to local governments to opting out? There is only one reason to opt out. Property tax digests would continue to increase due to annual increases in market values of properties, resulting in higher tax collections.

District 10 State Representative Victor Anderson (R-Cornelia) explained that the impact of local governments opting out is the potential of receiving higher taxes. “If property values increase at a higher rate than inflation, local governments (and school boards) would get more taxes by opting out,” he said.

During the Cornelia Commission meeting at the beginning of January, it was discussed that if HB 581 was already in place, the city would see in 2025 a reduction in property taxes of approximately $111,000 if inflation was 3% in 2024.

Should the county and/or the cities opt out, they can not request a referendum for FLOST.

SEE RELATED: Local governments face staying in HB 581 or opting out

The Habersham County Board of Education (BOE) is opting out for this reason. It could see a significant reduction in property tax collections due to the inflationary cap. Also, the BOE cannot collect a FLOST tax that would offset that reduction since it already receives an education local option sales tax.

Requesting relief

For the last several years, taxpayers have requested all local governments to reduce spending, cut millage rates, or both in an effort to reduce the tax burden on property owners. HB 581 takes steps to provide some property tax relief to taxpayers but it does not address spending. The bill does not restrict the local governments from increasing budgets or millage rates.

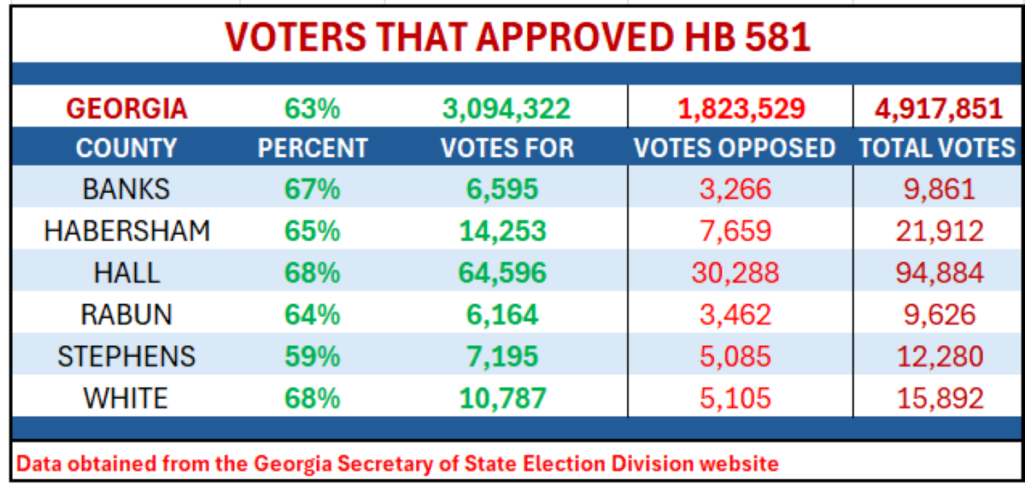

HB 581 gave property owners an opportunity to vote for themselves to receive property tax relief that local elected officials have been reluctant to provide. On November 5, voters held their “public hearing” for property tax relief. For those elected officials that consider opting out, they should take into consideration that 65% (14,253 voters) of Habersham County voters opted them in to HB 581.

HB 581 gave property owners an opportunity to vote for themselves to receive property tax relief that local elected officials have been reluctant to provide. On November 5, voters held their “public hearing” for property tax relief. For those elected officials that consider opting out, they should take into consideration that 65% (14,253 voters) of Habersham County voters opted them in to HB 581.