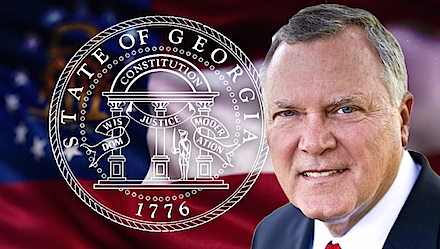

Gov. Nathan Deal unveiled a state tax cut proposal Tuesday that would save individuals and businesses over $5 billion over the next five years.

The proposed legislation updates the existing tax code and addresses state revenue projections from the Federal Tax Act.

Break for taxpayers

House Bill 918 would double the standard deduction for Georgia taxpayers of all filing statuses, effective Jan. 1, 2018. In addition, it would reduce the income tax rate for individuals and businesses from 6 percent to 5.75 percent effective Jan. 1, 2019.

The measure would further lower the tax rate to 5.5 percent as of Jan. 1, 2020, with approval from the General Assembly and governor.

“This bill keeps more of taxpayers’ hard-earned money in their pockets by doubling the standard deduction and reducing income tax rates,” says Deal.

Break for airline industry

The measure would also be a boon for the airline industry. It eliminates the state sales tax on jet fuel.

Rep. Dan Gasaway of Banks County says that tax break was included after heavy lobbying by the airline industry. He says it was tacked onto the tax bill as a “fool proof” way to insure passage.

Supporters of the jet fuel tax break say it will make the state more competitive by encouraging airlines to fly more direct flights from Georgia.

First tax cut in decades

Calling it “one of the biggest tax cuts in state history” Deal publicly threw his support behind the plan during a joint appearance Tuesday with Lt. Gov. Casey Cagle and House Speaker David Ralston. Cagle and Ralston also voiced their support for the plan.

District 104 Representative Chuck Efstration (R-Dacula) is sponsoring the legislation.

Experts project Georgia will receive billions in new revenue as a result of federal tax reform. Deal says the legislation he unveiled Tuesday “addresses Georgia’s projected windfall while balancing the state’s fiscal health and protecting our AAA bond rating.”

The last time Georgia increased its standard deduction was in 1981. State tax rates have remained the same for decades. Georgia set the individual tax rate at 6 percent in 1937. The corporate tax rate of 6 percent has been in effect since 1969.

Deal says he’s confident the General Assembly will pass the bill quickly. “The sooner I sign this landmark reform legislation,” says Deal, “the sooner taxpayers may file.”