A former North Georgia used car dealer has pleaded guilty to wire fraud in a $3 million scheme that defrauded lenders, federal prosecutors said.

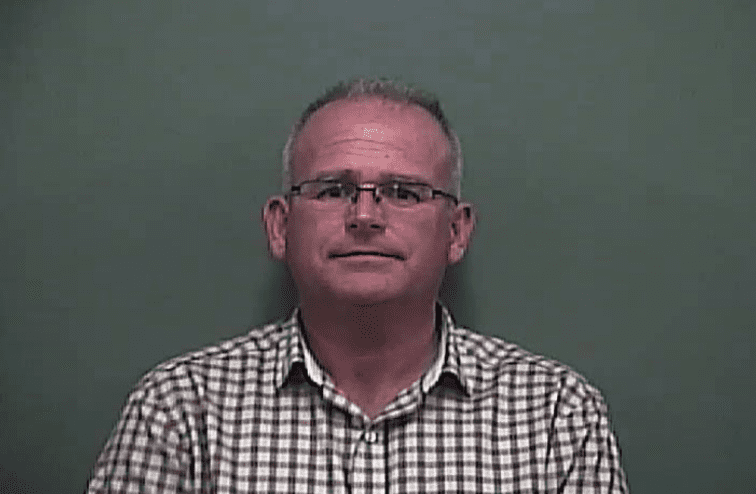

Mitchell “Mitch” Simpson, 56, of Cornelia, is scheduled to be sentenced on October 8.

Simpson is the former owner of Mitch Simpson Motors in Cleveland. According to a news release from the U.S. Attorney’s Office of the Northern District of Georgia, the dealership took out millions in loans by lying to lenders.

“This defendant abused the trust of the companies that loaned him money to operate his car dealership,” said U.S. Attorney Ryan Buchanan.

Deceptive practices

According to Buchanan, between early 2012 and early 2019, Dealer Financial Holdings LLC, Americash Advance, Inc., and Floorplan Xpress, LLC-OK each provided Simpson with a revolving line of credit, known as floor-plan financing, to buy vehicles to resell to customers.

When Simpson wanted to borrow money to purchase a vehicle to add to his dealership’s inventory, he would contact one of the lenders with information about the vehicle and the requested loan amount. Financing agreements required Simpson to disclose if the vehicle was subject to other liens or security interests.

Prosecutors said Simpson used the same car as collateral for multiple loans, which was illegal under the terms of those agreements. To hide this double and triple floor-planning, prosecutors said Simpson made false and misleading statements and omitted material facts in his communication with lenders.

In addition, the U.S. Attorney’s Office said Simpson operated ‘out of trust’ by not promptly repaying the lenders what he owed. They accused him of playing a shell game with vehicle titles and said he did not always provide lenders with truthful information about vehicle locations and whether they had been sold.

Authorities arrested Simpson in 2019. The Federal Bureau of Investigation is investigating the case.

Senior Supervisory Special Agent of FBI Atlanta’s Gainesville Office Mitchell Jackson said Simpson’s conviction demonstrates the agency “will not tolerate anyone who fraudulently steals or takes money that they did not earn.”

He added, “Simpson deceived the lenders who placed their trust in him and now he will be held accountable for his greed.”