White County, Cleveland, and Helen officials are considering putting a 1 percent sales tax on the November ballot. If approved, revenue from the Floating Local Option Sales Tax (FLOST) could only be used to offset property taxes.

During Monday’s White County Commission meeting, County Manager Derick Canupp presented a detailed analysis of the sales tax’s potential effects.

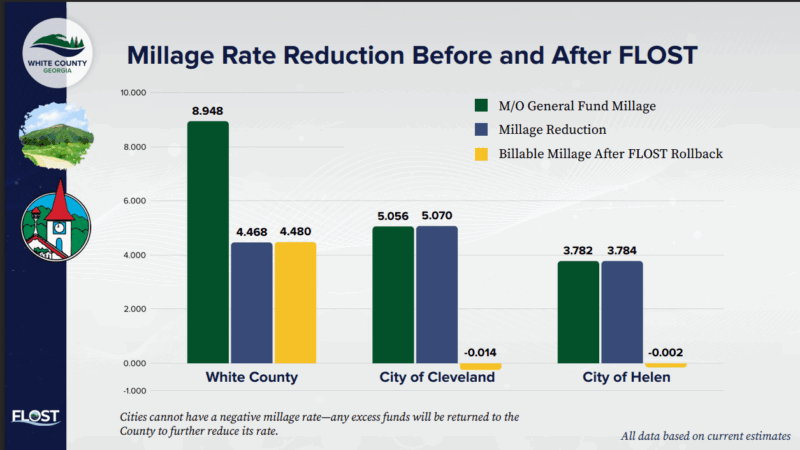

Canupp said the current General Fund Millage rate for the unincorporated areas of White County is 8.98. If the sales tax is approved, the millage rate would be reduced to 4.48 mills, and city residents would see a zero millage rate.

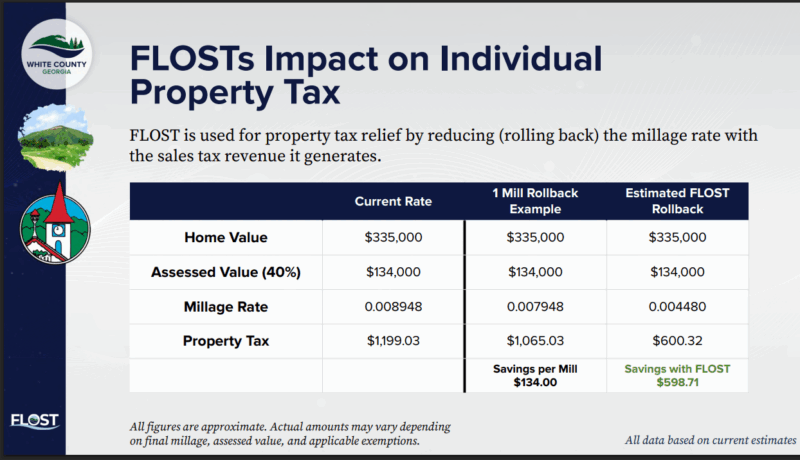

According to the information presented, a property owner with a home value of $335,000 would see a savings of $598.71 using the FLOST tax revenue to reduce the millage rate.

Canupp and the commissioners emphasized that all funds from the new tax can only be used to lower property taxes.

It was noted during the meeting that tourists and others from outside the county shopping here would pay for just over 60 percent of the tax funds that will be collected.

The commissioners and the county are prohibited from promoting the new sales tax, but White County Commission Chairman Travis Turner told those attending Monday’s meeting “You have to resolve within yourself if you have an opportunity to spread your property tax amongst those who are visiting with our area and you can save approximately $600 on your property tax on the White County Government, White Game Board Commissioners only. While I know my answer, you’ve got to resolve that for yourself if this is placed on the ballot.”

Canupp said there will be a meeting on May 20 of city and county officials to discuss placing this issue on this November’s ballot.

If approved, the sales tax would only be collected for a five-year period ending December 31, 2030.

This article has been corrected to reflect that the upcoming meeting will be held on May 20, not June.