The Demorest City Council received the city’s preliminary 2025 balanced budget that included three millage rate options for the council members to consider. City Manager Mark Musselwhite presented the city’s budget during the council’s work session Tuesday afternoon.

Millage rate

The 2025 budget Musselwhite presented to the council was based on a millage rate of 7.16 mills, a one mill increase. Musselwhite told the council that based on the budget they could cut to reduce the millage rate. He demonstrated what property revenues looked like with three millage rate options.

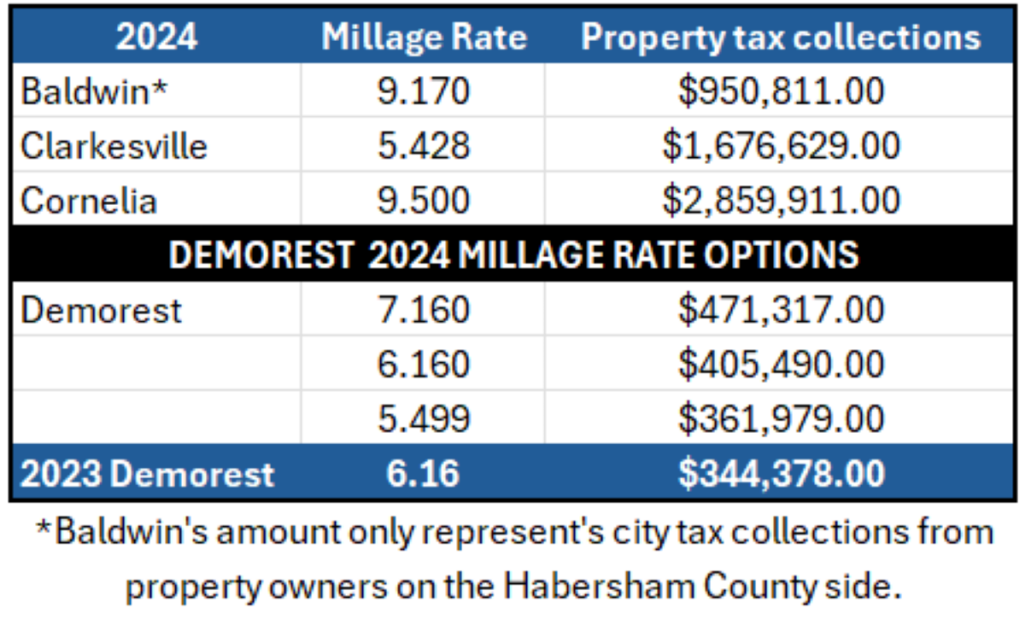

He first compared the property tax revenues generated in Clarkesville, Cornelia, and Baldwin and compared those revenues to Demorest. See the table below for the 2024 property tax collection comparison by city. The table also demonstrates the three millage rate options and tax collections presented to the city council.

Musselwhite explained that the city is advertising the one mill increase. However, the council has the option to leave the millage rate at 6.16 mills. “If you all were to roll it back, you’re talking from 7.16 to 6.16, roughly $65,000. We would have to cut to roll that number back” he said.

Musselwhite explained that the city is advertising the one mill increase. However, the council has the option to leave the millage rate at 6.16 mills. “If you all were to roll it back, you’re talking from 7.16 to 6.16, roughly $65,000. We would have to cut to roll that number back” he said.

According to documents presented at the work session, the proposed increase for property with the homestead exemption with a fair market value of $175,000 would be $102.92. For a non-homestead exempt property of the same fair market value would see an increase of $116.27 over last year’s collections.

Budget

Musselwhite presented a balanced general fund budget to the council for 2025, with revenues and expenses being equal. The total budget for all funds has expenses being less than revenues, resulting in a surplus.

The Demorest proposed 2025 general fund budget revenues are made up of taxes and fees for services prior to any advance from the water fund. Those revenues equal $1,236,356, a decrease of $1,380 from the current year’s budget. The advance from the water fund to subsidize the general fund will be $1,390,986, a decrease of $199,998 from the current year. With both revenue streams, the general fund revenues will be $2,627,342. General fund expenses match revenues resulting in a balanced budget.

The total budget expense including all funds is $11,094,628 for the city, with revenues coming in at $11,540,201, resulting in a surplus for the total budget of $445,573.

After the budget presentation, Mayor Jerry Harkness addressed the council. “You all have a little bit more time to go through this,” he said.

Musselwhite told the council that they could call him or come see him about the budget. He added, “I just need to hear the direction you all want me to take this budget. That belongs to the Mayor and Council.”

Public hearings

Should the city council take action on doing the full rollback, there will be no public hearings. However, due to the proposed millage rate increase, Demorest has advertised the dates for public hearings for citizens to speak in favor of or in opposition of the proposed increase.

The first two public hearings will take place on Tuesday, October 15. The first public hearing will take place at 12 p.m. with the second meeting being held at 5 p.m. The final public hearing will be held Tuesday, October 22, at 6 p.m. At which time, the council may take action on the millage rate increase.

All three public hearings will take place in the Demorest Municipal Conference Center at 250 Alabama Street in Demorest.