At its regular meeting on Tuesday, March 4, the Demorest City Council approved a resolution granting the city the ability to move forward with economic development through redevelopment powers. While this marks the first step, the approval is just the beginning of a lengthy process before the city can fully receive these powers.

The next step in the process is for the resolution to be presented by local state legislators for consideration and approval by both the State House and Senate. Should the resolution pass through the state legislature, it will then need to be signed by the Governor. This process will begin during the current legislative session, and if successful, it will set the stage for voter approval.

The final hurdle for the resolution is a referendum that will appear on the November ballot. Only the city of Demorest voters would see the referendum and vote on the city’s Redevelopment Powers Act.

Why the Need?

City Manager Mark Musselwhite explained that the redevelopment powers would enable the city to create a Tax Allocation District (TAD) specifically for property redevelopment. This district would provide the financial means for infrastructure installation and improvements, including assistance with costs incurred by developers to redevelop properties within the designated area.

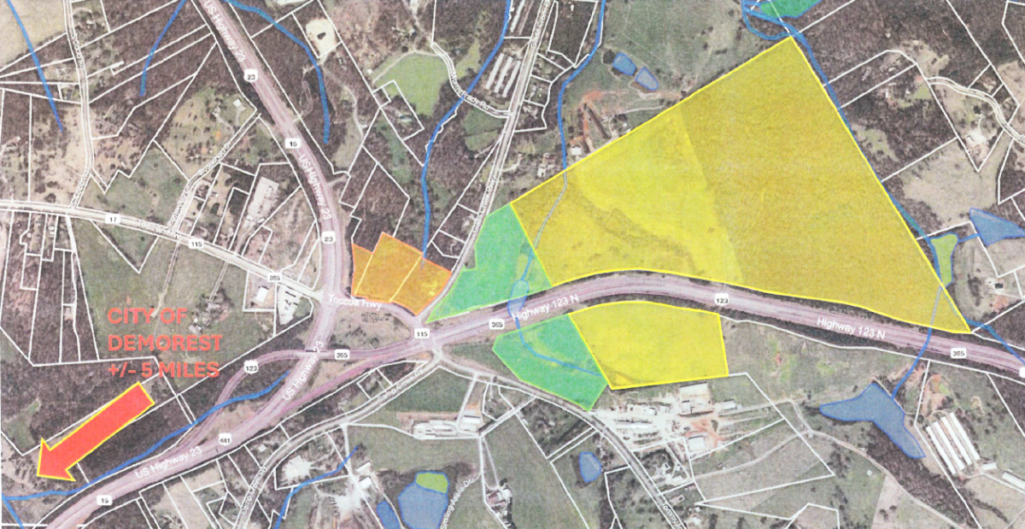

Artisan Land Companies approached the city seeking assistance to provide primarily sewer infrastructure for several parcels of land near the intersections of GA 365, GA 17, and U.S. 441, adjacent to the Tom Arrendale interchange near the Stephens County line.

The proposed development would be located adjacent to the Irvin Family property, which recently received approval from the county commission for a zoning change to High Intensity for the purpose of building a mixed-use commercial development at the intersection.

According to Artisan Land Companies’ CEO David Branch, the company is under contract to purchase two tracts totaling approximately 147 acres and anticipates acquiring an additional 28.8 acres. The mixed-use development will include medical facilities, offices, retail space, and residential areas.

Developer’s Requests

Branch outlined several key requests for the city to facilitate the development. These include annexing the Artisan and Irvin-owned properties into the city, creating a zoning district that allows for mixed-use development, and extending the city’s sewer line from Double Bridge Road north along GA 365 to the properties. The city would then establish a TAD to reimburse costs related to the sewer extension and the site’s development. Branch noted that the tap and impact fees paid by developers would also help cover the cost of the sewer line extension.

Estimated Sewer Costs

Branch presented the city with an estimated cost for extending the sewer line. The new 8-inch sewer main, extending approximately 30,200 feet (5.72 miles), would cost between $4.82 million and $8.43 million, depending on the final construction costs.

Annexation Process

One of the challenges facing the project is that the property is not contiguous to the city’s current boundaries, which would make annexation difficult. However, the law permits a city to annex land using a “spoke and stem” method if the property is owned by the municipality.

To make this work, Artisan and the Irvin Family would need to donate a small parcel of land fronting U.S. 441 to the city of Demorest. This would allow the city to annex the small parcel and make the development site contiguous to city property, thus enabling the project to move forward.

What is a Tax Allocation District (TAD)?

A Tax Allocation District is a tool used by municipalities to facilitate the redevelopment of underserved or economically stagnant areas. It creates a special fund, separate from the city’s general fund, that can only be used within specific districts for designated projects. TADs help developers by providing financial incentives for infrastructure development and property improvements.

The TAD process occurs in three phases:

First phase: A baseline property tax is set for the district, and the city collects property taxes above that baseline for up to 20 years.

Second phase: The city can use funds from the TAD to reimburse the costs of providing infrastructure and the developer can use funds for site development, such as tree clearing and grading.

Third phase: Once the TAD expires (typically after 20 years), any new property taxes from the district will benefit the city directly without restrictions.

Next Steps

According to Branch, the next steps include the city, Artisan Land Companies, and the Irvin Family working together to create a Memorandum of Understanding (MOU) that outlines the roles, responsibilities, and timelines for each party. The stakeholders will also need to meet with Habersham County to gain the commission’s approval for this approach to redevelopment.

As Demorest moves closer to these key steps, the city council’s recent approval of the redevelopment powers resolution is an essential milestone in the process of bringing this development project forward in the future.

The project has numerous hurdles to clear before it can move forward. If approved by voters, the project could move forward. However, it won’t be immediate. The sewer line extension and water line improvements will have to occur in that area to accommodate the project site. Artisan would also have to remove trees and grade the property to provide building sites for new businesses to be built.