The Cornelia City Commission will reconsider two agreements from Norfolk Southern Railroad and hold a millage rate public hearing at their Tuesday night meeting.

Railroad agreements

The two railroad agreements have been before the commission twice over the last year and both entities want something in return.

Cornelia wants a smoother rubberized railroad crossing on South Main Street, and Norfolk Southern wants to remove the bridge on Hoyt Street, a project they have wanted to complete for many years.

It appeared that both parties had come to an agreement last December; however, Cornelia did not move forward with allowing Norfolk Southern to remove the Hoyt Street bridge resulting in Norfolk Southern backing out of constructing the smoother rubberized railroad crossing last February.

Both contracts are identical to what was presented last December.

The contract for removing the Hoyt Street bridge states that Norfolk Southern will remove the bridge and clean up the area at their cost.

For giving Norfolk-Southern permission to remove the bridge, Cornelia will receive $100,000. The railroad will be responsible for the installation of temporary barricades to the bridge approach. Cornelia will be responsible for the installation of permanent barricades once the project is completed. According to Cornelia City Manager Donald Anderson, the bridge has been closed to vehicle traffic since April.

The contract for the smoother rubberized railroad crossing on South Main Street states that Cornelia will pay Norfolk Southern approximately $224,429 to construct the improved crossing. Cornelia’s portion will be $100,000. Georgia Department of Transportation will contribute at least $124,429 to the project, funding that State Senator Bo Hatchett secured last year.

Millage rate public hearing

The commission will hold a public hearing for public comment as they consider a millage rate increase for 2023 property taxes. The current millage rate for property owners in the city of Cornelia is 8.5 mills. The new millage rate will increase by 1 mill to 9.5 mills. According to Anderson, the recommended increase is “to continue to provide the level of services that our citizens expect.”

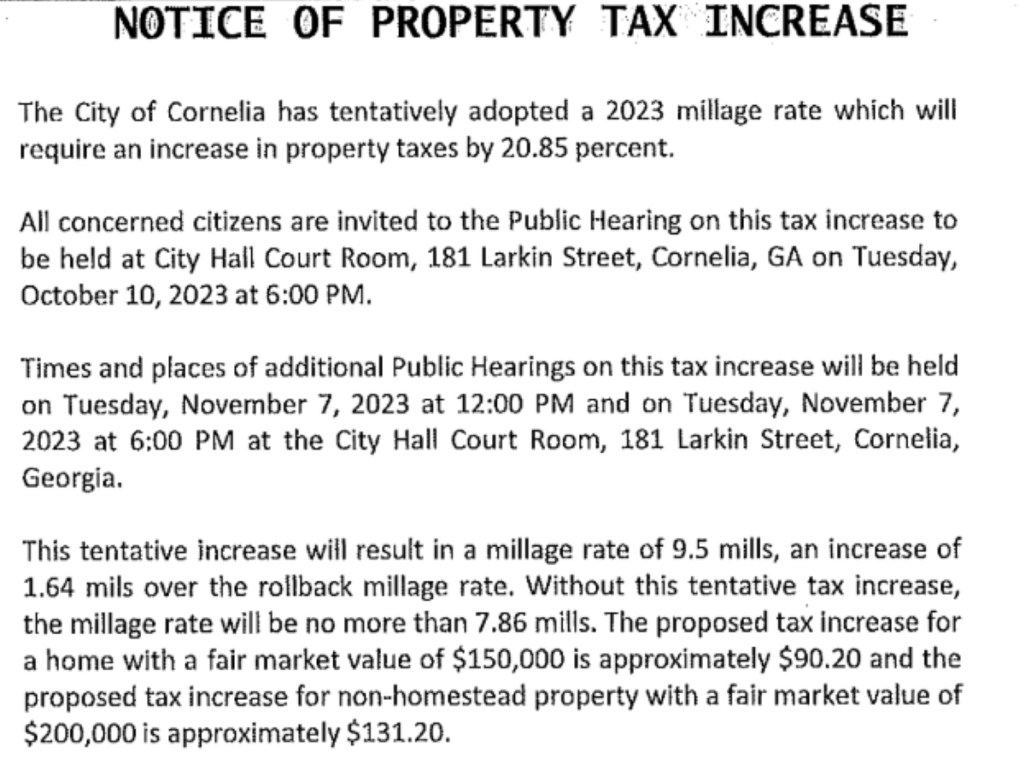

According to the public Notice of Property Tax Increase, the tentative increase will result in a millage rate of 9.5 mills, an increase of 1.64 mills over the rollback millage rate of 7.86 mills. Property owners will see a 20.85% increase in their property tax bills over last year’s bill.

The proposed tax increase for a home with a fair market value of $150,000 will see an increase in their tax bill over last year of approximately $90.20. A non-homestead property owner with a fair market value of $200,000 will see an increase in their tax bill over last year of approximately $131.20.

According to Anderson’s recommendation, those property owners with the homestead exemption will see a tax reduction this year of $171 due to the state’s one-time homestead exemption grant.

The Cornelia City Commission regular meeting will be held Tuesday, November 7th at 6:00 p.m. in the Municipal Building Court Room at 181 Larkin Street in Cornelia. The City Commission will also hold a work session at 5:00 p.m. in the Municipal Building Conference Room at the same location. The public is encouraged to attend both meetings.