(WASHINGTON | GA Recorder) — A sweeping $1.9 trillion coronavirus stimulus package is headed to President Joe Biden’s desk after the U.S. House passed the latest pandemic relief measure Wednesday on a party-line vote.

The massive bill includes a new round of $1,400 direct checks for many Americans, including millions of Georgians, as well as an extension of expanded unemployment checks to assist people whose jobs vanished in the past year of shutdowns and lockdowns. Thursday will mark the one-year anniversary of the World Health Organization’s declaration that COVID-19 was a global pandemic.

The package sends financial help to state and local governments, restaurants, child care centers, and schools, and provides money to increase COVID-19 testing and vaccines, lower health insurance premiums, and boost broadband access.

The measure also vastly expands the child tax credit, temporarily giving most parents monthly checks instead of once-a-year tax reductions or checks. That provision greatly strengthens the social safety net for poor and middle-class families, and is expected to cut child poverty in half.

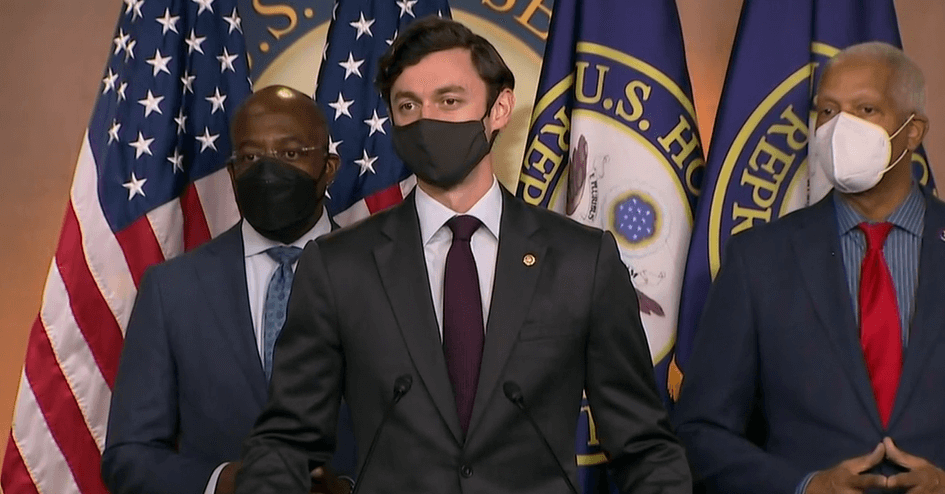

“So much is coming out of this bill that puts us in a decidedly different place,” U.S. Sen. Raphael Warnock said at a Wednesday press conference with the rest of Georgia’s Democratic congressional delegation. “This pandemic has been a long, dark night. But just over the horizon, the sun is starting to shine again.”

Biden is expected to sign it on Friday, White House press secretary Jen Psaki said at a briefing. “This legislation is about giving the backbone of this nation – the essential workers, the working people who built this country, the people who keep this country going – a fighting chance,” Biden said in a statement immediately after the vote.

As with Saturday’s 50-49 vote in the Senate and the initial vote in the House, no Republicans joined the Democratic majority in support of the bill, which passed on a 220-211 vote. One Democrat, Rep. Jared Golden of Maine, opposed the bill, saying in a statement that he would have preferred a more narrowly tailored measure.

Democrats have lauded the stimulus measure — which is nearly as large as the relief package approved last March, following stay-at-home orders and rising case counts — as providing immediate help to constituents still struggling with the effects of a virus that has caused more than 29 million confirmed infections in the U.S. and more than 525,000 deaths.

“This not only gets us to the other side of the crisis, it really starts healing the wounds that have been caused,” Majority Leader Steny Hoyer, (D-Md.), said ahead of the vote.

Republican legislators have unanimously opposed the measure. They have decried it as unnecessary when the economy has shown signals of recovery, arguing that too little spending is focused on the virus’s effects and that portions of the bill won’t be spent for several years.

“All the economy needs before it comes roaring back is a full and complete reopening, not endless shutdowns or payouts to liberal states and special interest groups,” said Georgia GOP Congressman Barry Loudermilk, who said he offered an amendment that would have prohibited federal funding from going to schools that did not reopen for in-person learning.

School reopenings

Rep. Jason Smith of Missouri, the ranking Republican on the Budget Committee, blasted the measure for spending less than one in $10 on boosting COVID-19 testing, treatment and vaccinations.

“Only 5% of the K-12 education funding will be spent this year, even as Americans are told this money is needed to reopen their children’s schools,” Smith added, citing a cost projection from the Congressional Budget Office.

White House officials have said they believe the school funding will be spent much faster than the CBO estimates.

Still, Republicans linked much of their criticism to the slow pace of school reopenings across the country. During Tuesday’s floor debate, Republican legislators rose one after another to request that the House instead take up a bill narrowly focused on helping kids return to in-person learning.

Democrats opposed the tactic, accusing GOP lawmakers of delaying a final vote on much-needed aid to Americans, including money that schools can use for addressing learning lost over the past year and buying equipment needed to reopen buildings.

“Republicans won’t help us … Why? Because Donald Trump’s name won’t be on the stimulus checks? Is that how easily they will abandon their constituents?” asked Rep. Steven Horsford, (D-Nev.).

While congressional votes on the pandemic stimulus package have been deeply divided, public opinion surveys have shown a sizable majority of Americans support the legislation.

A survey by Pew Research Center found 70% of adults favor the stimulus measure, and 28% oppose it. Democrats and those who lean Democratic overwhelmingly favor it, with 94% in support, and Republicans are divided, with 41% in support and 57% opposed.

No minimum wage increase

The final package largely aligns with the outline that Biden initially proposed. The Senate removed a proposal to boost the minimum wage to $15 an hour, and narrowed both the size of the unemployment benefits and the income limits for receiving the direct checks.

Of the $350 billion in direct aid to state, local governments, territories and tribes, $195 billion would go to states and the District of Columbia, and $130 billion would be divided among cities and counties. Another $10 billion was carved out for capital projects, like improving broadband access.

Georgia Sen. Jon Ossoff said that, for the first time, the aid for smaller local governments will go directly to them rather than through the state.

“This is economic stimulus from the bottom up and the middle out, not from the top down,” Ossoff told reporters Wednesday. “Zero percent of the tax credits and stimulus checks go to the top 1%. This is stimulating and recovering economically by getting help directly to working class and middle class people and investing in the public health effort to defeat COVID-19.”

The bill set limits on how the state and local aid can be used, barring officials from using the dollars to pay down pension costs or to pay for new attempts to cut taxes. And it would ensure that states get at least as much as they received under the last aid package.

The bill’s passage comes days ahead of the mid-March deadline set by Democrats who wanted to pass the funding before the last extension of unemployment benefits is set to run out.

The White House has said Americans are likely to see the direct checks hit their bank accounts by the end of the month. The new monthly checks stemming from the expanded child tax credit are set to begin in July.

While the child tax credit is only expanded for a year under the legislation, Rep. Richard Neal, a Massachusetts Democrat who chairs the Ways and Means Committee, expressed confidence this week that the provision will become permanent.

“What we did is unlikely to go away,” Neal said, describing it as harder to get something out of tax laws than to get something added to those statutes.

Money headed to states and local governments

The House Committee on Oversight and Reform has released estimates for how much each state and locality can expect to receive from the $350 billion in direct aid in the final version of the bill. In Georgia, the state and localities are set to receive about $8.4 billion.

Those projections do not include other money that will flow through state and local governments, such as money for schools and for transit systems.

Georgia Recorder Deputy Editor Jill Nolin contributed to this report.