Congressman Doug Collins (R-Ga.) is lauding this week’s passage of a Republican bill aimed at gutting financial regulations put in place during the Obama administration.H.R. 10, called the Financial Choice Act, reverses many of the regulations established by the Dodd-Frank Act in 2010.

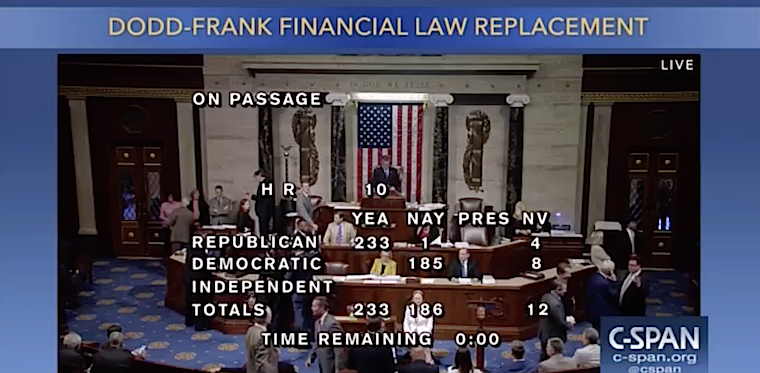

The Ninth District Congressman from Gainesville voted in favor of H.R. 10 Thursday helping it pass the House of Representatives along party lines, 233-186.

“Dodd-Frank established a legion of heavy-handed, inconsistent regulations that have burdened our community banks and, therefore, our community members especially those in rural and low-income contexts,” says Collins.

Democrats argue the Republican bill rolls back measures that protect consumers and curb excessive risk-taking on Wall Street.

“It’s shameful that Republicans have voted to do the bidding of Wall Street at the expense of Main Street and our economy,” Maxine Waters, the top Democrat on the House panel, told reporters.

Collins counters it rolls back “bureaucratic overreach” and “delivers accountability” to the Consumer Financial Protection Bureau (CFPB) which was established in the wake of the financial crisis of 2007-2008.

“Northeast Georgia businesses, farmers and families have suffered under Dodd-Frank’s regulatory tyranny, and today we’re bringing opportunity back to our neighbors,” Collins says.

The bill would reform the Consumer Financial Protection Bureau (CFPB) and effectively delay the implementation of the Fiduciary Rule, which would require financial advisors to put the clients’ best interests above their own when working with retirement accounts.

Read more: DOL Fiduciary Rule Explained as of June 9th, 2017

This legislation also applies the principle outlined in the REINS Act, which was introduced by Collins in January. Under REINS, any new rules established by institutions like the Treasury Department, Securities and Exchange Commission or CFPB would have to receive Congressional approval if their costs exceeded $100 million.

The bill now moves to the Senate where it faces an uphill battle in its present form. At least eight Democrats will have to sign onto the legislation for it to be approved. Senate Republicans are expected to seek bipartisan support as they draft their own legislation to overhaul Dodd-Frank regulations.