It is budget time again for those government entities that have a July 1 through June 30 fiscal year. Habersham County government and the Habersham County Board of Education are diligently working to get their final numbers together to have their budgets finalized over the next month.

Shortly after the budget is approved, the County Commission and the Board of Education will set the millage rate for property taxes, due later this fall. The budget comes first and then the millage rate.

Taxpayers have a way to see what the historical annual budgets and property taxes assessed are for both entities. It is called the Current Property Tax Digest and 5 Year History of Levy. It lists the total property values and property taxes each year for the current year and the previous 5 years. The Current Property Tax Digest and 5 Year History of Levy is advertised in the legal organ immediately after the millage rate is set.

This document lists out several categories of properties that are taxed and their values. It lists the gross tax digest, exemptions, and the net tax digest. The net maintenance and operations digest and the maintenance and operations taxes levied are used to factor the millage rate.

The net maintenance and operations digest is also referred to as the net tax digest or the net M&O digest. This value is the gross digest minus property exemptions.

The maintenance and operations taxes levied is also referred to as the M&O taxes or the taxes needed to pay for the general fund budget.

Habersham County government

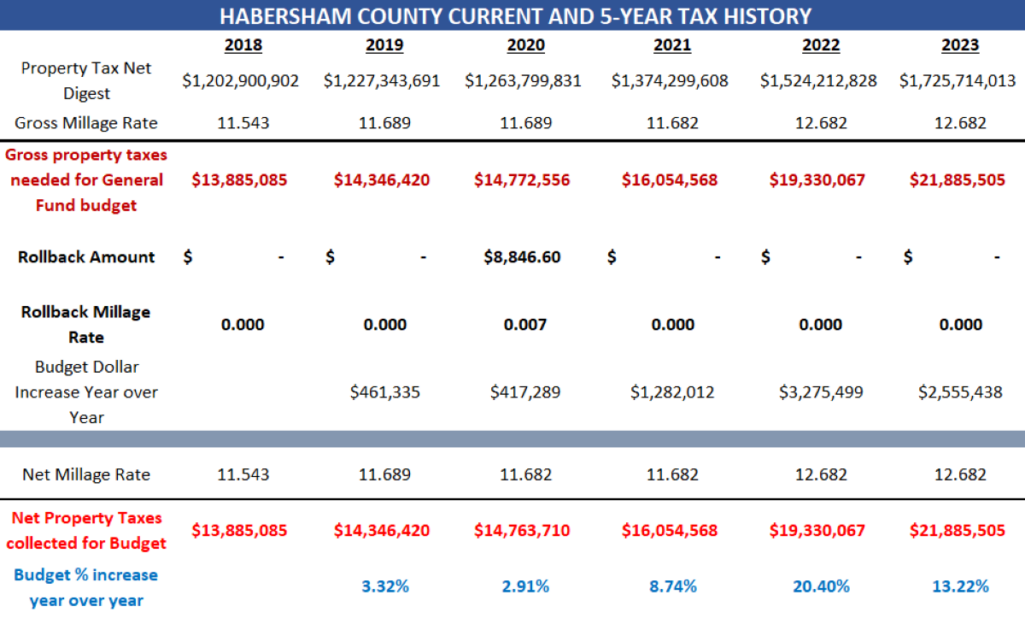

The Commission’s current and 5 year tax history for the county demonstrates the increase over the last six years not only for the tax digest but also the property taxes needed to pay for maintenance and operations in the general fund budget.

The general fund covers expenses for fire, sheriff’s office, recreation, administration, commission, roads, animal control, and other departments.

A taxpayer can see the increases for the county over the last six years with a quick glance. Property taxes needed to cover the general fund budget have increased since 2018 by 57.62% or $8,000,420. The majority of that increase came after 2020. The increase in property taxes since 2020 is 48.15% or $7,112,949.

A taxpayer can see the increases for the county over the last six years with a quick glance. Property taxes needed to cover the general fund budget have increased since 2018 by 57.62% or $8,000,420. The majority of that increase came after 2020. The increase in property taxes since 2020 is 48.15% or $7,112,949.

Since 2018, the net tax digest (property values) has increased by 43.46%. Since 2020, the digest has increased by 36.55%. In both scenarios, the property taxes required to operate the county have outpaced the increase in the net digest.

Habersham Board of Education (BOE)

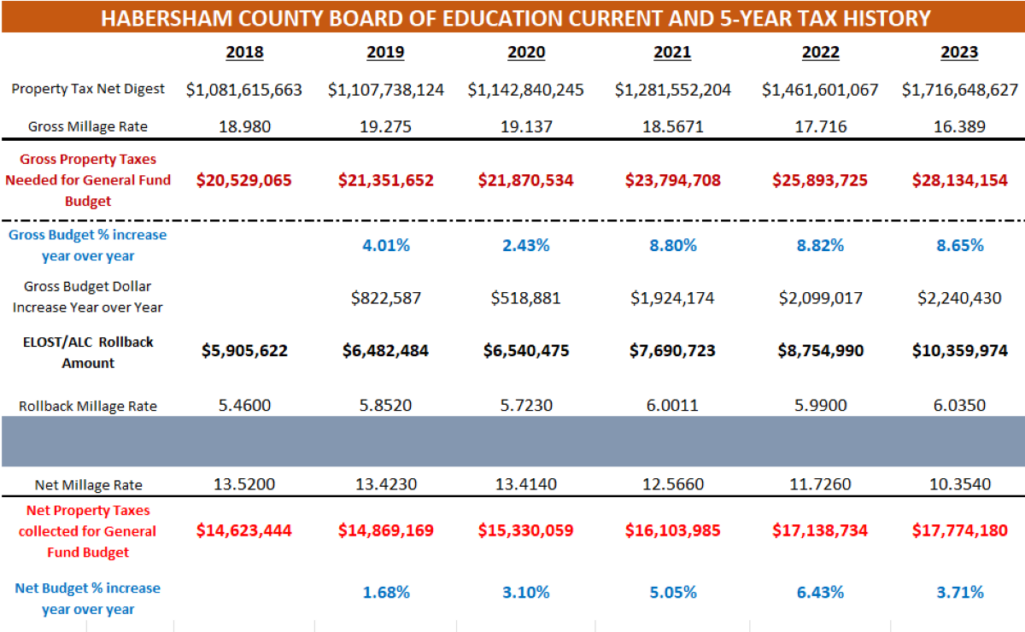

The BOE’s current and 5 year tax history for the county demonstrates the increase over the last six years not only for the net tax digest but also the property taxes needed to pay for maintenance and operations in the general fund budget.

The Board of Education has several funding sources that offsets their annual budget. Its overall budget exceeded $111 million in 2023, according to their financial audit. However, state and federal funding sources reduce that amount significantly. Also, the BOE collects an Education Local Option Sales Tax and an Alcohol Tax that reduces property taxes for property owners.

However, there are still maintenance and operations expenses (general fund budget) that are not covered by other funding sources. Property owners make up the difference.

The Board of Education has increased their general fund budget needs over the last six years as well. However, due to the increases in ELOST and Alcohol Taxes, it offsets some of those needs.

The BOE’s gross property tax needs for the general fund budget (prior to rollback) has increased since 2018 by 37.05% or $7,605,089. However, the majority of that increase has come since 2020. That amount is $6,263,621.

The BOE’s gross property tax needs for the general fund budget (prior to rollback) has increased since 2018 by 37.05% or $7,605,089. However, the majority of that increase has come since 2020. That amount is $6,263,621.

Fortunately, the general fund percentage increases did not outpace the percentage increases in the net tax digest. Even though the general fund increased, the net tax digest increased more. This resulted in the BOE being able to reduce the gross millage rate a little each year with the exception of 2019, when it had its highest gross millage rate of 19.275 mills. Since that time, the BOE has been able to reduce the gross millage rate each year down to 16.389 mills in 2023.

ELOST/Alcohol tax

ELOST and the Alcohol Tax have increased significantly providing a large rollback each year. Since 2018, those two taxes combined have increased by 75% or $4,454,353. The majority of that increase has come since 2020. That increase amount is $3,819,500.

Even though the net tax digest and the rollback taxes increased, so did the general fund budget. Had the general fund budget not increased, the gross millage rate would have decreased further, capitalizing on the property tax rollback, saving property owners even more in property taxes.