ATLANTA (Georgia Recorder) — The rising cost of child care and workforce shortages have hit Georgia families and providers hard in the aftermath of the pandemic.

While the state did see the burden alleviated via temporary federal relief programs for families and financial support for child care workers, those programs have ended. Advocates for children are calling on state lawmakers to now increase financial support for Georgia’s families. A pending proposal aims to introduce tax credits to offer parents some support, but time in the legislative session is quickly running out. Friday is the last chance for lawmakers to take action before the 2025 legislative session closes.

Child care expenses are a concern that hits home for John Jackson, head of financial planning and analysis for BlackRock in Atlanta and a member of the board of directors for Georgia Early Education Alliance for Ready Students.

“As a dad of three daughters, I know how challenging it can be to find reliable, high-quality child care,” Jackson said. “I’ve had mornings where our backup child care is unavailable, and it’s instant chaos in terms of my wife and I trying to figure out who’s going to miss work, what schedule and meetings will be changed and how we are going to close those gaps.”

Several nonprofits like GEEARS and Voices for Georgia’s Children are advocating for financial support for families, especially those with young children. In the COVID era, many parents pulled their children out of child care facilities while teachers also left their workplaces due to stay-at-home orders. This allowed providers to lower their prices significantly, but as parents have returned to work and new families search for a place to take care of their children, providers have struggled to maintain enough openings at an affordable price.

“The child care system that we have now really doesn’t work for families who need care, or for the teachers who teach and care for the kids who are in care,” said Ife Finch Floyd, director of economic justice for the Georgia Budget and Policy Institute. “Often people call that a market failure, where we can’t always meet the needs of the demand.”

Child care providers face a hard time attracting new employees and retaining current workers while keeping prices affordable for families. Since other employers can offer more competitive wages, many workers may opt for a career outside of the child care industry. Many providers have raised prices to cover their expenses and increase workers’ wages.

A bill sponsored by Republican Sen. Brian Strickland from McDonough aims to ease the pressures of the increasingly expensive cost of raising a family for Georgians.

Strickland proposes to allow taxpayers to claim 50% of a portion of their child care expenses on their state taxes, up from 30%. His bill would also create a new $250 credit per child six years of age or younger. It also aims to offer a $1,000 tax credit for child care facilities for each employee whose child is six years of age or younger and is enrolled in the facility.

Strickland’s bill has now been tacked onto House Bill 136, legislation designed to increase financial support for foster care providers. Last year, Strickland was involved in a Senate study committee that explored child care costs in Georgia, where he says he learned more about how child care access affects not only families but businesses too. His work on this bill comes from a personal place – his own family life.

“Having two young children myself, a lot of people that I come in contact with have kids the same age as my kids and we’re are all struggling with the same thing,” Strickland said. “We’re all trying to figure out ‘can we make enough money working to cover child care costs?’ It’s something that’s affecting people all around our state.”

The bill has received bipartisan support throughout the session. Advocates and legislators emphasize the economic benefits of strong support for early education. A flyer passed out by GEEARS at a recent press conference read, “Every $1 invested in high-quality early learning yields as much as $13 in savings.”

“This is a piece that is designed to help the taxpayer,” Strickland said. “This is keeping more of the money that you’d otherwise be paying the government.”

Since the credits offered by Strickland’s bill are non-refundable and cannot exceed the taxpayer’s tax liability, they would cost the state tax revenue. State estimates of the original bill’s cost calculated the hit to the state budget to be about $179 million in the first year. Floyd said that the cost is likely higher than this number now, as the federal match provision increased the the state credit from 40% to 50%.

“We are supportive of tax policy that supports families with low to moderate/middle income,” said Floyd. “GBPI has long supported tax credits for the families of everyday Georgians and individuals to make sure that they can afford their basic needs and help plan for their futures.”

While there is bipartisan consensus on the reality of rising child care costs, there are differing views on the best ways to offer relief.

Kennesaw Democratic state Rep. Lisa Campbell proposes the “Georgia’s Children First” trust fund in House Resolution 396. Her bill would take a portion of Georgia’s budget surplus to support the Child and Parent Services Program, allocate money for child care providers and help purchase supplies that young children need, like diapers.

“The annual rate of child care in Georgia right now is about $11,000 per child per year,” Campbell said. “And that’s in many cases more expensive than a college degree.”

Creating a new trust fund in Georgia requires a constitutional amendment. Although her proposal did not receive a committee hearing before the Crossover Day deadline in early March, Campbell hopes to continue supporting this bill next year when bills filed this year that don’t pass in 2025 can have a second chance. She said Strickland’s tax credit is a “great thing to do.”

She also recognizes the role that gender plays in the fight to support families.

“When women exit the workforce to care for children and come back, it’s often very difficult to catch up in terms of the types of roles and responsibilities that they are offered,” she said. “It’s very rare that a woman will catch up to her peers who did not leave the workforce.”

The proposed tax credit was unanimously approved by the Senate in late March. Strickland frames this bill as a “step” towards increasing support for Georgia’s working families. Inside and outside of the Capitol, supporters of legislation like this are advocating for Georgia’s young children to be prioritized in various ways.

“We at Voices are big advocates for dollars and support for quality afterschool and summer learning programming as well,” said Polly McKinney, advocacy director for Voices for Georgia’s Children. “We know that school aged children deserve developmentally appropriate, safe, educational and fun places to grow into the happy, healthy and wise adults who will carry the rest of us into the future.”

The House approved Strickland’s proposal Wednesday but made a tweak to an unrelated part of the bill, so it still needs another vote in the Senate to make it to the governor’s desk and turn into law.

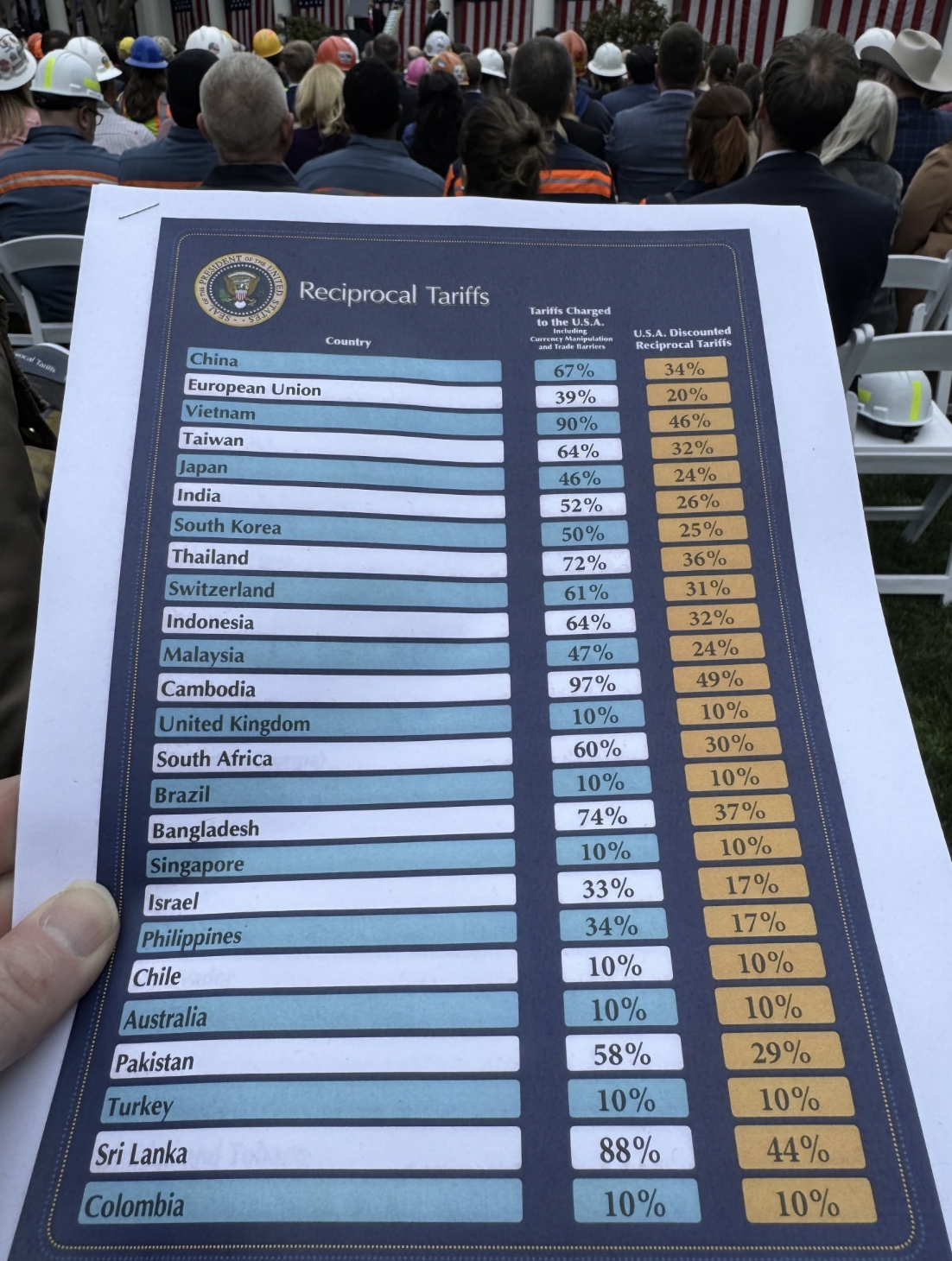

Vietnam is a small country, but a competitive exporter, particularly in broadcasting equipment, microchips and computers. And the U.S. is a big customer.

Vietnam is a small country, but a competitive exporter, particularly in broadcasting equipment, microchips and computers. And the U.S. is a big customer.