WASHINGTON (GA Recorder) — President Joe Biden said Wednesday the climate and child care provisions in his domestic spending agenda could still become law this year, even as the larger plan has stalled in the Senate over other items that Biden conceded may not pass — such as an expanded child tax credit.

In a nearly two-hour news conference, the president conceded his so-called Build Back Better bill would not pass the Senate in its entirety, though “big chunks” could still pass this year.

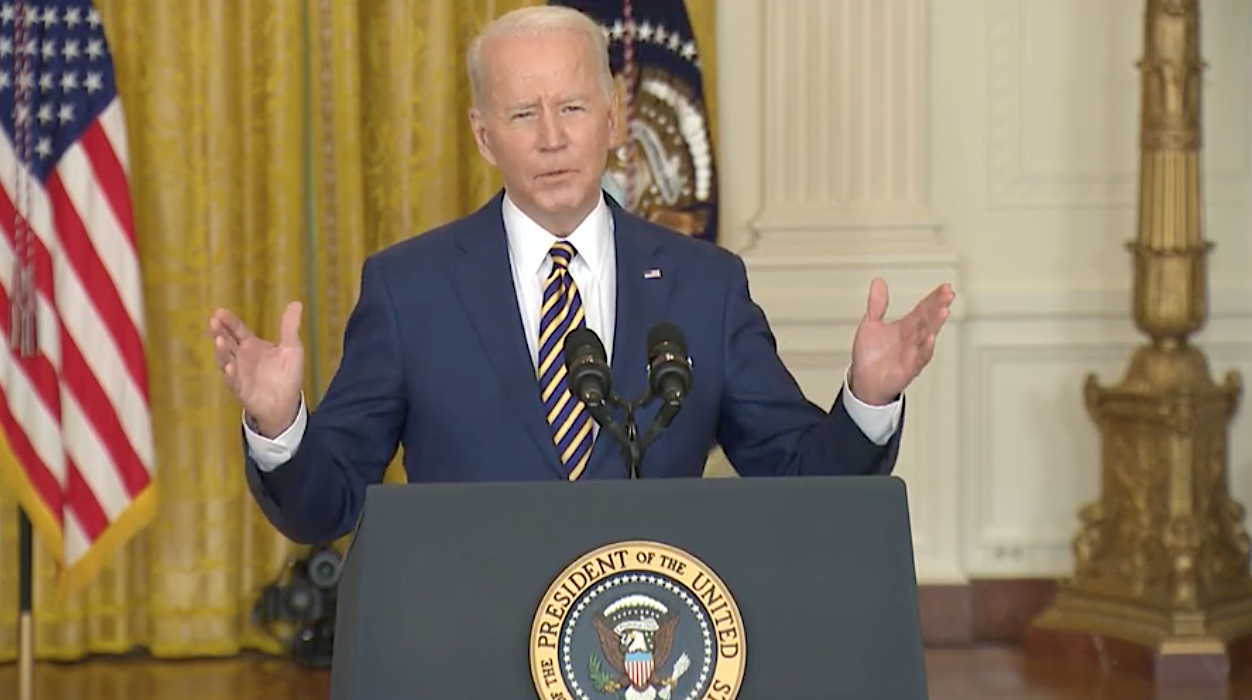

WATCH: Biden press conference

Two key Democratic holdouts in the evenly divided Senate, Joe Manchin III of West Virginia and Kyrsten Sinema of Arizona, supported many of the individual pieces in the massive bill, Biden said.

“It’s clear to me that we’re going to have to probably break it up,” Biden said. “I know that the two people who opposed, on the Democratic side at least, support a number of things that are in there.”

“I think we can break the package up, get as much as we can now, come back and fight for the rest later,” he said.

Manchin appeared to deal a fatal blow to the $1.85 trillion package late last year when he said in a Fox News appearance he could not support the measure in its entirety.

Democrats in the 50-50 Senate planned to use a legislative procedure known as budget reconciliation to pass the bill with a simple majority but needed all their members to support it.

Still, more than $500 billion in climate spending and tax breaks, including clean energy tax credits and consumer tax breaks for electric vehicles, proposed in the package have the support to pass the Senate, Biden said.

And Manchin “strongly supports” the child care funding in the package, he added.

But Biden said two other priorities would likely have to be dropped: an extension of the expanded child tax credit and boosted funding for community colleges.

“There’s two really big components that I feel strongly about that I’m not sure I can get in,” Biden said. “They are massive things that I’ve run on, that I care a great deal about, and I’m going to keep coming back at.”

The child tax credit that Congress passed as a temporary COVID-19 relief measure provided $3,600 per year for children younger than 6 and $3,000 per year for older children, up from $2,000 before the pandemic. The spending bill would have extended that enhancement, which instead expired at the end of 2021.

An early White House proposal would have provided two years of free community college. That measure was removed from the House-passed version of the bill, which still provided $1.2 billion in funding for community college programs.

There is no clear Senate procedure to pass individual components of the bill.

To work around the normal 60-vote threshold to advance legislation, Democrats began the budget reconciliation process that is allowed once per fiscal year. Democrats would have to restart that process for a smaller package, or win 10 Republican votes.