The Federal Deposit Insurance Corporation (FDIC) has reached settlements in its lawsuits against two former Community Bank & Trust officers and eight former Habersham Bank officials.

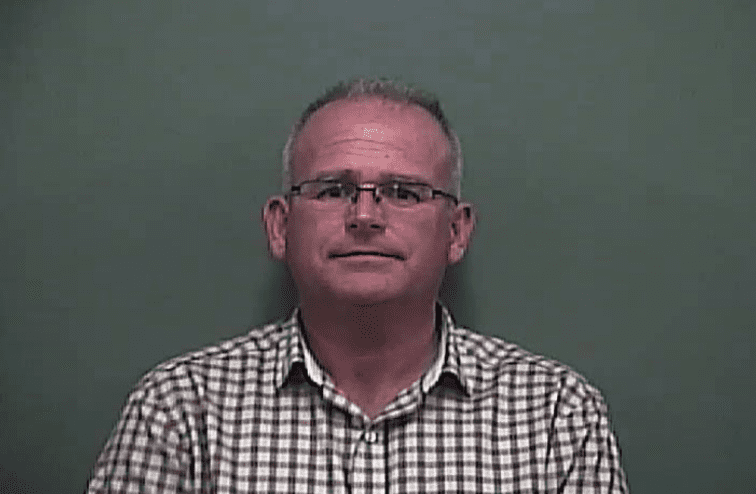

FDIC spokesman David Barr says $3.8 million was paid to the federal agency in late November to settle the nearly four-year old lawsuit against former CB&T President Charles Miller and Senior Vice President Trent Fricks.

A $3.5 million settlement was reached in September in the suit against former Habersham Bank officials David D. Stovall, Edward D. Ariail, Bonnie C. Bowling, Michael C. Martin, Michael L. Owen, M. Edward Hoyle, Frank E. Felker, and Andrew Coker.

Both banks were seized by the Feds after amassing millions of dollars in money-losing loans. Community Bank and Trust was seized in 2010; Habersham Bank in 2011.

CB&T lawsuit and settlement

The lawsuit against Fricks and Miller, filed in February of 2012, alleged Fricks approved home loans without verified borrower financial information, adequate appraisals or authorization to exceed his individual lending authority. The suit also claimed Miller failed to supervise Fricks and implement corrective measures after he was notified in 2006 of Fricks’ activities.

The FDIC had sought to recover more than $11 million in losses the agency claims the bank suffered as a “direct and proximate result of the Defendants’ breach of fiduciary duties, negligence and gross negligence.”

The attorney for the two men, Robert Long of Alston & Bird in Atlanta, denied the allegations. Contacted for comment about the settlement, he issued the following statement to Now Habersham:

“The case has settled and has been dismissed with prejudice and is thus over. But my clients, Mr. Fricks and Mr. Miller, paid no money whatsoever to settle the case. The settlement agreement will be a matter of public record if it is not already, and it speaks for itself, except I note that the settlement agreement expressly acknowledges my clients’ denial of the merits of any of the FDIC’s allegations of wrongdoing in the lawsuit.” ~ Robert Long, attorney

READ: CB&T Settlement and Release Agreement

Attorney Doug Stewart of the Gainesville, GA law firm Stewart, Melvin & Frost who filed the lawsuit in U.S. District Court on behalf of the FDIC says the settlement was funded by insurance proceeds.

Habersham Bank lawsuit and settlement

The FDIC leveled similar claims of negligence against the eight former Habersham Bank officials it named in a $15 million lawsuit filed in February of last year.

David Stovall was CEO, a director and later president of the bank. Edward Ariail was a director and president. The others named in the suit were directors or held executive positions.

The suit claimed the former executives breached their fiduciary duty by approving negligent commercial real estate loans. Among other things, the FDIC suit alleged they failed to properly oversee the Bank’s lending function, improperly extended credit to borrowers who were not creditworthy and extended credit based on inadequate information about the financial condition of prospective borrowers and guarantors.

READ: Habersham Bank Settlement and Release Agreement

No admission of wrongdoing

According to court documents, settlements were reached in both cases to avoid the uncertainty and expense of further litigation. The agreements stipulate the settlements are not an admission or evidence of wrongdoing on the part of any of the defendants.

Both settlements release the defendants from future liability in FDIC claims that might arise from their service as officers and directors of the now defunct banks but reserve the FDIC’s right to seek court ordered restitution under the Mandatory Victims Restitution Act, “if appropriate.”

The settlements also stipulate the defendants can not profit from the banks’ failures. They must assign to the FDIC any of their shareholder dividends, interest or other payments resulting from the closing of the banks and/or subsequent litigation.

End of an era

CB&T was Habersham County’s oldest and largest bank at the time it was seized. According to FDIC records, the 110-year old institution had approximately $1.21 billion in total assets and $1.11 billion in total deposits. Habersham Bank was the second oldest bank in the county. It was 107 years old with assets totaling around $387 million and deposits of nearly $340 million around the time it was seized.

South Carolina-based SCBT, N.A., took over the failed banks’ operations in FDIC-brokered deals. CB&T and Habersham Bank were both reopened and later rebranded under the South State Bank name.