Habersham County commissioners voted 3–2 Monday to adopt the 2025 county millage rate. The new combined rate—including the general fund, hospital bond, and emergency services—drops to 13.067 mills, down from 13.085 last year.

County officials insist the majority of property owners will be shielded from tax increases due to Habersham’s Homestead Exemption and the new HB 581 exemption. But with higher property valuations, many residents remain worried about their upcoming tax bills.

Commissioners Kelly Woodall, Dustin Mealor, and Ty Akins voted in favor of the full rollback millage rate. Chairman Jimmy Tench and Vice-Chair Bruce Harkness opposed it.

What it means for homeowners

For a home valued at $300,000—which Interim Finance Director Kiani Holden said is now considered the county’s average—the new general fund millage rate of 11.272 will result in about $1,352 in county property taxes. That figure is based on 40% of the assessed value ($120,000) multiplied by the tax rate.

County Manager Tim Sims explained that Habersham’s “floating freeze” and HB 581 exemption protect more than 80% of residential properties from rising assessments. “So most everybody should be paying the same rate you were paying in 2022 unless you did something to your property that reset your value,” Sims said.

While the overall rate went down, a larger portion of property owners’ taxes will be applied to paying down the hospital bond debt. That rate climbed from 0.757 mills in 2024 to 1.129 mills this year because the county has exhausted the $5 million in SPLOST revenue that voters approved to pay down the debt.

“We can no longer pay the bond payment with SPLOST, so we have to pay the bond payment now 100% from property taxes,” Holden explained.

County finances and exemptions

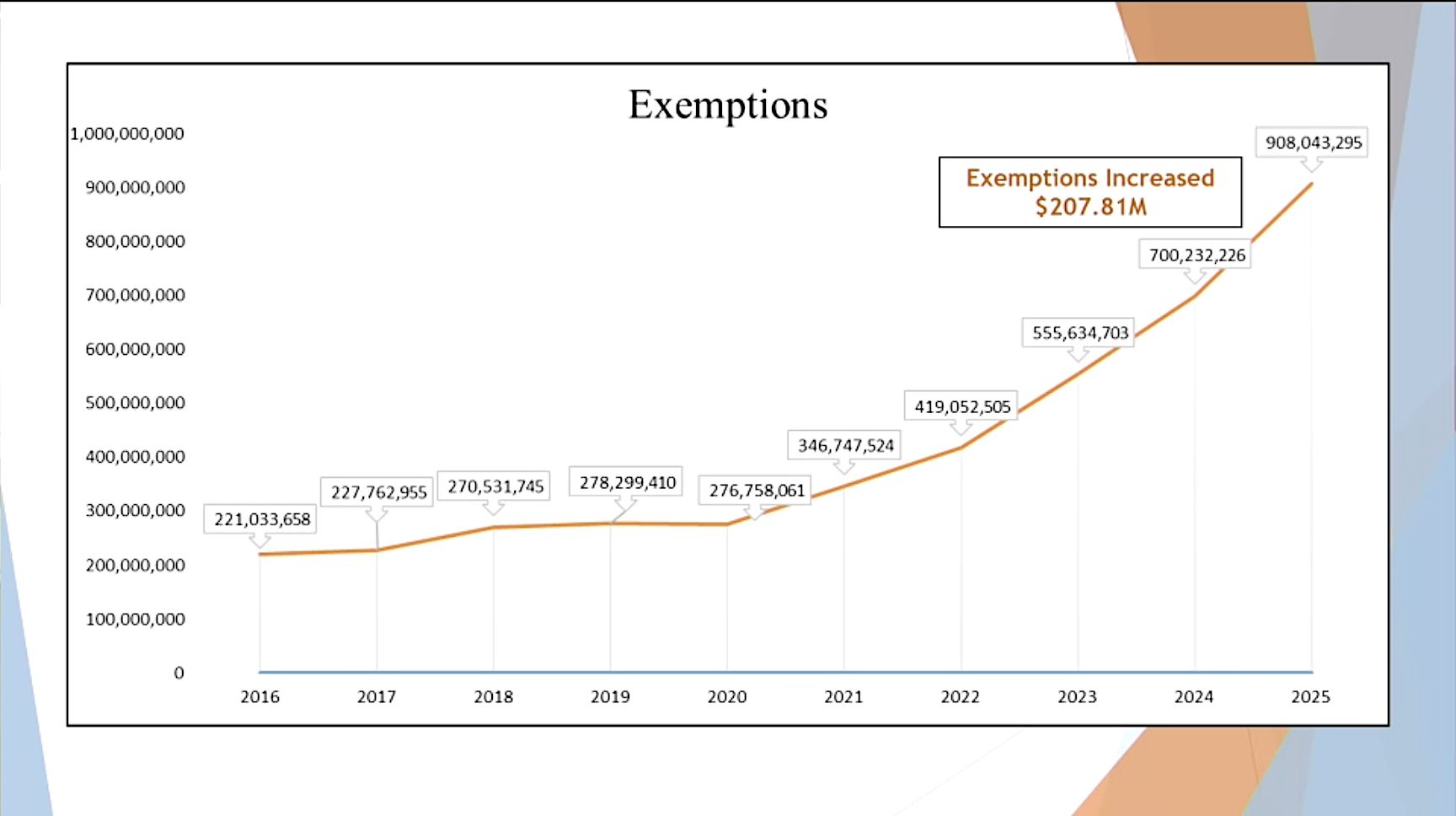

Holden reported that exemptions continue to rise dramatically, growing from $221 million in 2016 to $908 million in 2025.

“Our exemptions have risen exponentially over the last several years, but especially over the last year,” Holden said.

Even with those exemptions, Habersham’s tax digest grew by $151.4 million in new construction and improvements. The county’s net taxable digest now stands at $2.16 billion. At the adopted millage, officials expect to collect about $23.5 million for the FY 2026 budget, assuming a 98% collection rate.

Debate over reassessments

The 3–2 vote on the millage rate highlighted growing concerns about rising assessments. The most recent assessments were provided by an outside consulting firm that the county hired.

“Most everybody’s property’s jacked up tremendously… my eyes almost fell out when I opened up that little envelope,” Commissioner Harkness said.

“A lot of people are asking me, ‘Why are we paying a million dollars [to consultants] to jack people’s values up if we’re doing all these calculations to try to keep people’s taxes down?’” he said. Harkness argued that the rollback savings are “almost minuscule.”

Sims defended the reassessment, saying state law requires counties to maintain at least a 38.5% sales ratio or face a state-imposed reassessment. Sims said many commercial and industrial properties had long been undervalued. “For many years, the assessments have not been done as proactively as they should have been,” he explained.

Where the money goes

More than half (50.27%) of Habersham’s total millage rate supports the school system, which is expected to adopt its own full rollback next week. The county’s portion breaks down as follows:

- 40.98% general fund

- 4.11% hospital bond

- 4.67% emergency services

Within the general fund, nearly half supports public safety (18.02%), followed by general government (9.5%), judicial functions (5.06%), and smaller amounts for public works, recreation, health and welfare, housing and development, debt service, and capital projects.

Votes explained

No residents spoke for or against the millage rate during the public hearing.

Commissioner Woodall said he supported the rollback because “as long as we’ve rolled it back as far as we can and we’re saving the taxpayers,” it was the best option.

“We cut $4.2 million out of the budget. We made every effort to constrict our spending and we’ve rolled back to save the taxpayers the increase that they’ve seen in other areas. That’s my primary concern, and if you assure me that’s what we’re doing,” Woodall said, addressing Holden, “then I’m on board.”

Holden replied, “Absolutely.”

Chairman Tench voted no, citing frustration with lingering hospital bond debt. He noted his concern over the county’s previous multi-million-dollar bailout of Habersham Medical Center before Northeast Georgia Health System took it over. “That’s kind of a different subject; it’s not part of the millage rate,” Sims countered.

Harkness warned that rising assessments and tax bills are creating a breaking point for those on fixed incomes and longtime residents, many of whom he said feel they are being priced out of their own community.

“I hear every day people who have lived here for generations saying that it’s getting to where they’re getting taxed off of their own property and can’t even afford to still live here,” he said. “So, although we’re being told that there is no increase in the millage rate, somehow our taxes gradually increase, and someone has to take a stand and say we must stop this burdensome taxation on our citizens.”