With all of Habersham County’s cities agreeing to adopt a property tax relief bill approved by referendum by a majority of voters last year, cities are now looking ahead on what this could mean for them and their residents.

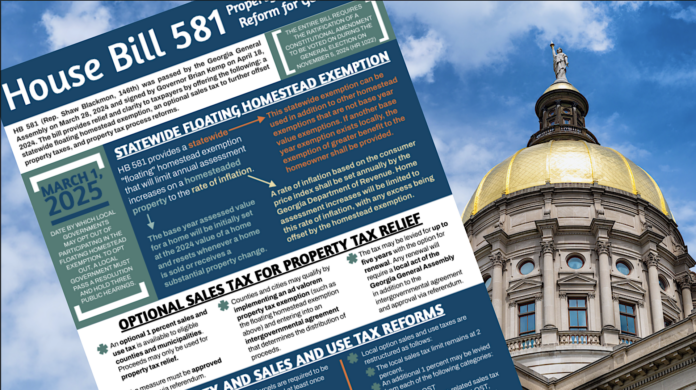

House Bill 581, as drafted, would cap homestead exempt property valuations to the inflationary rate determined by the Georgia Department of Revenue. The bill also requires reassessments of properties only every three years.

Now, in Habersham, HB 581 appears as though it will move forward as all seven cities and the county opt in.

According to the legislation, each county and its municipalities must be unanimous in adopting the homestead exemption to be eligible to vote on FLOST – a 1 cent sales tax that would have to be approved by voters at a later date. Revenue from FLOST, if approved, could only be used to rollback the millage rate.

Clarkesville

During a Monday, March 3 work session, Clarkesville city officials alluded to the weight FLOST – also known as a Floating Local Option Sales Tax – holds as potential revenue loss remains a possibility once property values are capped.

Now, City Manager Keith Dickerson said officials will likely look to form a partnership with a private entity that can educate the public on the need for FLOST.

“The next big push will be to try to find a group – the (Habersham County) Chamber of Commerce or Partnership (Habersham) – somebody to push for FLOST to see if we can get that passed,” Dickerson said. “That will probably be next year.”

Clarkesville Mayor Barrie Aycock, who does not intend to run for reelection, indicated during the work session that she could lobby for FLOST after she leaves office. City and county officials (elected or hired) are forbidden from officially endorsing items such as FLOST or influencing public opinion before it appears on a referendum.

Aycock will be able to do so once she steps down.

“Several people have been asking me, ‘What’re you going to do when you retire?’,” Aycock said Monday. “That, I think, is a way I can spend my time: To try to educate people (on FLOST).”

Dickerson said “rough assessments” on property will likely be available for review in April. “Then, we’ll be able to see how this is going to affect us,” he said.

Cornelia

In Cornelia, similar conversations are being had.

But Cornelia City Manager Dee Anderson didn’t lend as much weight to the potential passage of FLOST. A large percentage (60%-70%) of the tax base in Cornelia consists of commercial and industrial property, which cannot receive homestead exempt status.

Anderson and Cornelia Mayor John Borrow said they don’t believe the city will see an influx of homestead exemption applicants now that HB 581 is moving forward.

“We have a lot of people that have homestead exemptions already,” Anderson said. “The homestead doesn’t (apply to) industrial or commercial property.”

Anderson also noted that, if voters don’t approve FLOST in a future referendum, the city will likely have to increase the millage rate to account for revenue loss.

A mill is equal to $1 per $1,000 in taxable property value. In Cornelia, property is taxed at 40% of its value.

Currently, Anderson said the city of Cornelia receives around $100,000 a month from SPLOST (or Special Purpose Local Option Sales Tax) funds. Most of that revenue is allocated to roads and public safety.

Rabun

The town of Tallulah Falls is in a much different position, however.

Tallulah Falls, a town of just over 200 people, has an annual budget of around $350,000-$400,000. And with a lack of commercial property, the town’s revenue is almost solely driven by its residential tax base.

While the town also has opted in to HB 581 alongside its neighbors in both Habersham and Rabun counties, Mayor Mike Early has said officials are “taking a gamble” in doing so.

If FLOST isn’t approved by voters, Early fears the town could see significant revenue loss. In that case, a millage rate hike would be inevitable.

In Rabun, the three cities that collect property tax (Tallulah Falls, Clayton and Sky Valley) and the county have all announced decisions to opt-in.

Most counties across North Georgia have opted in as well, and though officials haven’t officially announced when FLOST could appear on the ballot, it’s likely to be decided by referendum in November of 2026.