Baldwin residents will see a significant increase in their 2022 property taxes if the city council approves their proposed millage rate increases.

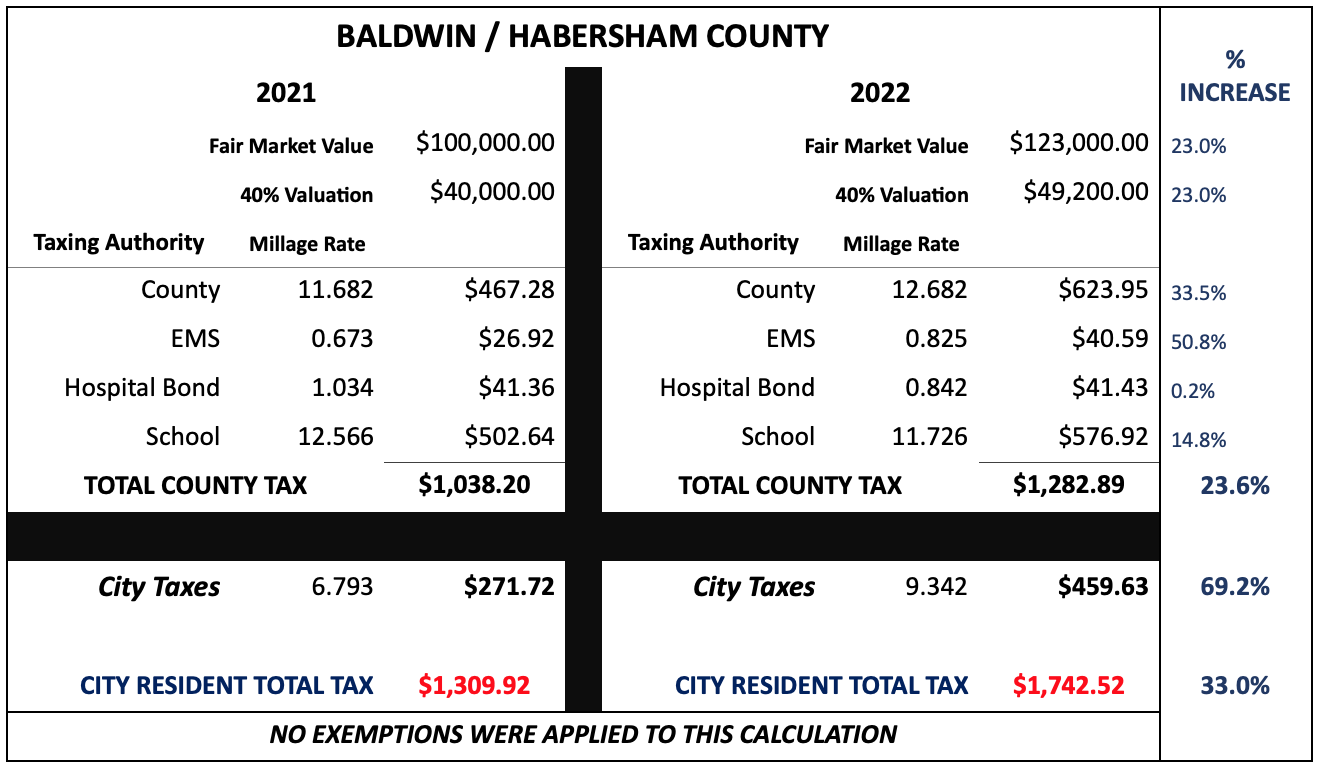

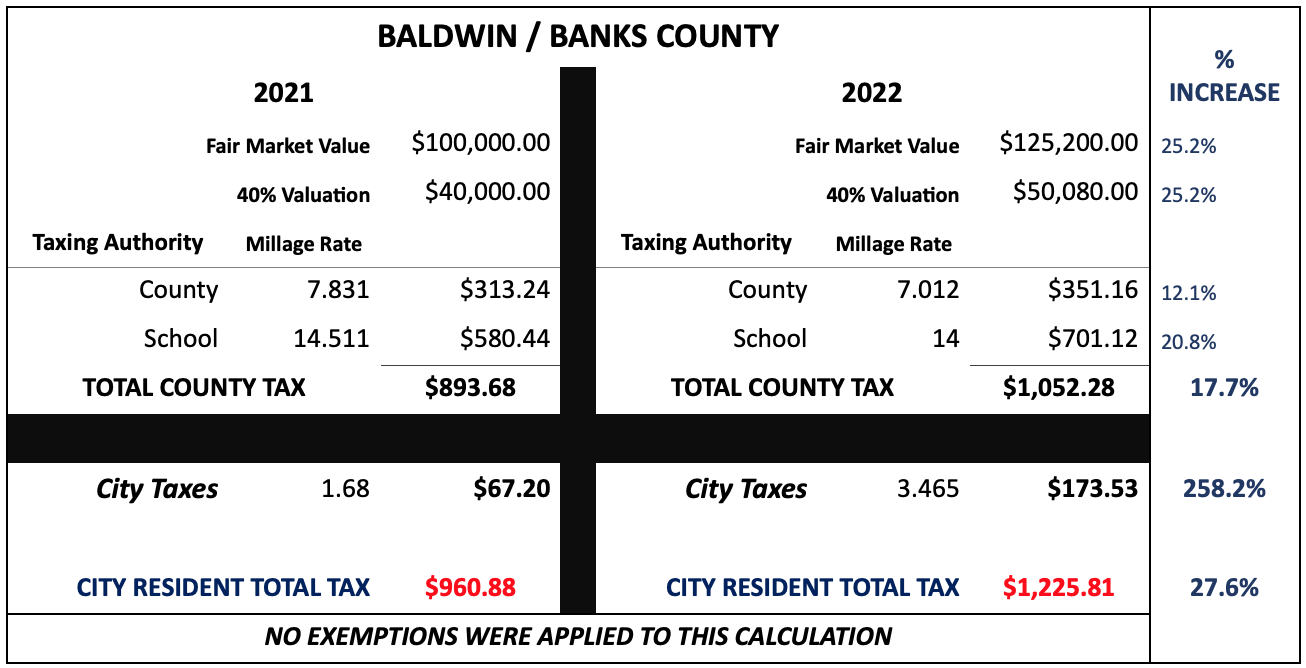

With recent reassessed values and county taxes factored in, the owner of a home valued at $100,000 in 2021 could expect to pay approximately $433 more in taxes this year if they live on the Habersham County side of Baldwin. A homeowner on the Banks County side would see their tax bill rise by approximately $265.

Proposed increase – Habersham

The Baldwin City Council has proposed a 2.549 millage rate increase for properties on the Habersham side of the city and a 1.78 mill increase for properties on the Banks County side. (Banks County uses Local Option Sales Tax dollars to offset property taxes and Baldwin receives a portion of those LOST funds.)

The 2021 millage rate for Baldwin/Habersham was 6.793. If approved, the 2022 millage rate would be 9.342, resulting in a 38% increase in property taxes from the previous year and a 58% increase over the rollback millage rate.

The Baldwin City Tax Digest for Habersham has increased this year by $10,316,67 with residential property valuations making up 75% of that increase. The average residential property valuation on the Habersham County side increased by 23%.

The city anticipates collecting $742,588 from Baldwin/Habersham and $83,790 from Baldwin/Banks. In 2021, anticipated collections were $469,889 and $33,486, respectively.

Proposed increase – Banks

Baldwin’s proposed 3.465 millage rate for Banks County property owners represents an increase of just over 106% and a 166% increase over the rollback millage rate. In 2021, the millage rate was 1.68.

The Baldwin City Tax Digest for Banks has increased overall by $4,249,556 with residential property valuations making up 74% of that increase. The average residential property valuation increased on the Banks County side by just over 25%.

Under the proposed millage plans, Baldwin anticipates collecting approximately $826,378 in property taxes, an increase of 64.17% over 2021’s anticipated collections of $503,375.

After reviewing Baldwin Financial Statements from prior years (available at (ted.cviog.uga.edu/financial-documents), the city has a fund balance of $1,430,726. In FY2021 alone, the city had a surplus of $431,853.

Baldwin City Council will be holding three public hearings to discuss the proposed millage rate increase. The meetings will be held at the Baldwin Municipal Courtroom at 155 Willingham Avenue on August 29, 2022, at 6:30 p.m.; September 6, 2022, at 6:30 p.m.; and September 12, 2022, at 6:30 p.m.

________

This article has been updated with corrected figures to show that the proposed millage rate increase on the Habersham side would be 2.549 mills representing an increase of 38%.